Session 4: Understanding mortgages

Introduction

Welcome to Session 4 of this free Open University course. This session you will focus on mortgages – loans used for buying homes.

Transcript: Video 1 Introduction to Session 4

The session explores the mortgage products available in the UK market – their interest rate and other characteristics – and examines the factors involved in making good choices from the product range. It explains why and how mortgages can be actively managed by borrowers through such options as overpaying, offsetting and remortgaging.

Having been at historic lows before and during the Covid-19 pandemic interest rates here in the UK and elsewhere around the world have risen quickly since the start of 2022 in response to the sharp rise in price inflation. This inevitably led to increases in mortgage rates too.

The session also examines the mortgages from the viewpoint of the lenders, including the factors that affect their decisions about making mortgage advances.

By completing the session you will not only become more knowledgeable about the mortgage market, but also more confident in making smart decisions about one of most important areas of personal finance.

By the end of this session, you should be able to:

- understand how banks and other lenders like building societies make decisions about providing mortgages

- know about the different types of mortgage products available and the interest rates that apply to them

- know about the benefits in proactively managing your mortgage – for example by periodically moving from one product to another

- understand the various costs involved in buying property

- know the risks involved in having a mortgage and how to manage these.

The first section will look at the factors that determine how much lenders will provide when you apply for a mortgage.

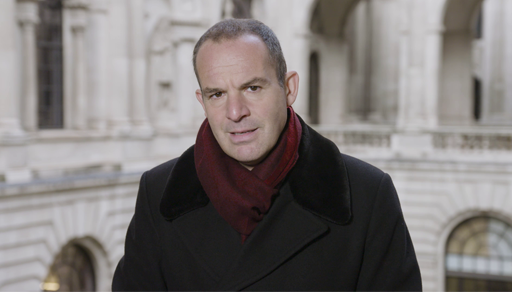

This Session is one of a suite comprising the course MSE’s Academy of Money and has been made possible by financial and content contributions by MoneySavingExpert.com.