7.1 Raising taxes for the first time in 800 years

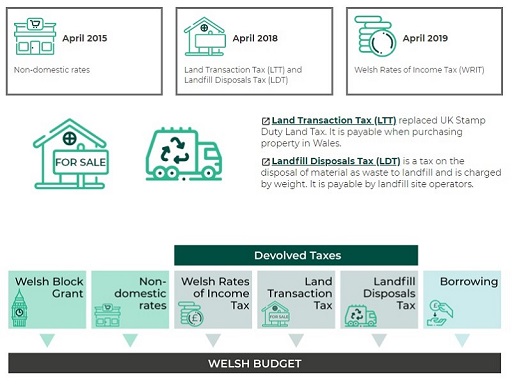

In 2018, the first Welsh taxes in 800 years were levied by the Welsh Government. These were landfill disposals tax and land transaction tax, replacing landfill tax and UK stamp duty land tax respectively.

The levying of these taxes necessitated the creation of the Welsh Revenue Authority which operates independently of the Welsh Government and is scrutinised by the Welsh Parliament.

From April 2019, the Welsh Government set the Welsh rate of income tax. Ministers could choose to vary the rate or keep it the same as the rates in Northern Ireland and England. Taxes are still collected in the same way by HMRC.

In 2018, the Welsh Government began to examine four new tax ideas. These are: vacant land tax, social care levy, disposable plastic tax and tourism tax.