1 Funding

The devolved government needs money to fund the services it controls such as the NHS in Wales through health boards and education through local authorities.

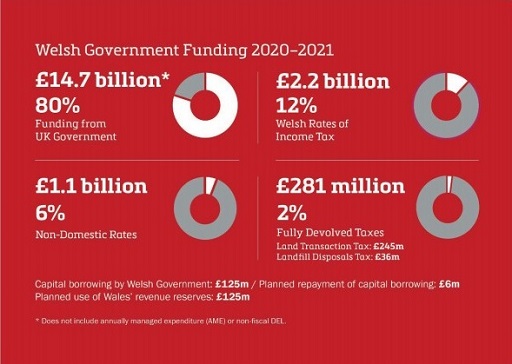

In 2019/20, the Welsh Government planned to spend about £18bn.

This funding was drawn from three main sources:

- money allocated by the UK Government

- money raised in Wales by means of taxation and other charges

- borrowing

Funding presents two major challenges: ensuring accountability and ensuring fairness.