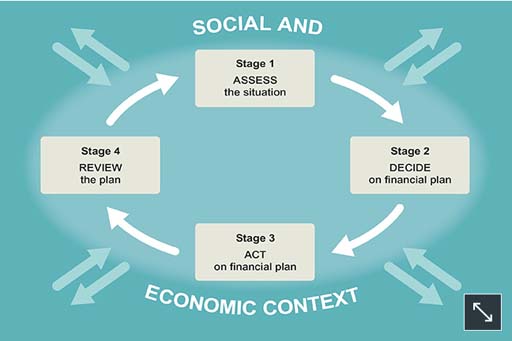

3.3.4 Budgeting (Stage 4: reviewing the financial plan)

As budgeting is an ongoing process a review date is usually fixed. Initially, this review may be in just one month’s time, since at the beginning there may be some trial and error in the budgeting process. After a while it should settle down, and the review dates can be extended to, say, every six months.

At the review date a new cash flow statement needs to be calculated, with all the necessary information entered, to see whether the budget is working. The new cash flow statement allows the plans of the budget to be compared with what actually happened. It’s probable that more amendments may be needed as it becomes clear how easy or difficult the budget was to implement. A new budget is also required if the goals for which the budget was designed change. A further reason for review would be if income changes, and a new budget with more adjustments in expenditure is then required.

External influences, such as price rises and interest rate changes, are also likely to impact on budget plans. For example, a 5% annual inflation rate applied to Jenny’s expenditure would increase it from an annual figure of £13,080 (12 × £1090) to £13,734 – an increase of £654. Jenny’s income may have risen to accommodate this increase, but incomes may not always change at the same rate as prices so monitoring and reviewing these changes is important.

It’s easy to see how such external changes can greatly impact on financial plans, given that after her budgeting exercise Jenny was planning to save only £300 p.a. (£25 × 12 months). This is one reason why financial experts suggest adding a little on to planned expenditure to allow for price increases. For instance, a look at previous gas and electricity bills can show how much energy prices have risen. This precautionary approach may help to avoid some unpleasant surprises.