4.1.4 Compounding of interest

As you completed the calculations in the quiz, you may have started to think of some factors that could complicate the calculation of the interest charge. For example, what would be the interest charge if some of the principal sum is repaid during the course of the year?

In many cases, the answer is that the interest rate calculation will be based on the average balance of the principal sum during the year. For instance, if £10,000 is owed at the start of the year and £100 is repaid halfway through each month, then the outstanding balance at the end of the year would be £8800. The average balance of principal outstanding during the year would be the average (mean) of the balance at the start and at the end of the year, or £9400 = ((£10,000 + £8800)/2). Based on this average balance, the interest for the year at 7% p.a. would be £658 = (£9400 x 7/100) – rather less than the £700 if no repayment of the principal sum had been made.

What happens if the borrower does not repay the interest due to the lender? Again, this will depend on the details of the contract with the lender and their attitude to borrowers who fall into arrears. Normally, the lender will add the interest charge left unpaid to the principal sum. This means that the following period’s interest charge is going to be higher since the borrower will be paying interest, not only on the original principal sum but also on the unpaid interest. This is known as compounding, and can quickly enlarge debts.

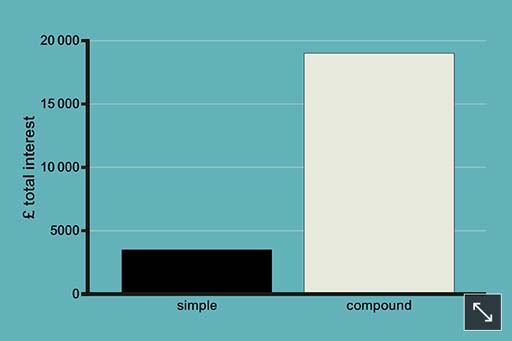

The example of compounding that you see in Figure 3 illustrates what happens if someone borrows £1000 at an interest rate of 35% and makes no repayments over ten years. Over this period of time, the debt would rise from £1000 to £20,107 (£19,107 interest on top of the £1000 borrowed). This is much more than if interest had been charged on a simple rather than compound basis – simple interest over ten years would have been just £3500.

The dangers of compounding were demonstrated vividly in a famous case which came to court in the UK in 2004. A debt of £5750 grew to the staggering sum of £384,000 in 15 years. In the event, the debt was (unusually) cancelled for being ‘extortionate’. Yet it showed the risks of compounding very clearly.

The precise practice for computing the interest charge varies among different lenders – and interest can be calculated by different lenders at different time intervals. One of the pieces of financial small print it is always vital to read is the basis on which interest is charged – that is, how often and by reference to what terms. For instance, if a person is repaying some of the principal sum of their loan regularly, the interest charged will be lower if the interest charge is calculated on a daily basis, rather than on a monthly or an annual basis. (Interest charged on an annual basis will be the least favourable option if repayments of the principal sum are being made.)