2.3.5 Investment funds: alternative risk profiles

The previous section set out the types of funds available to investors.

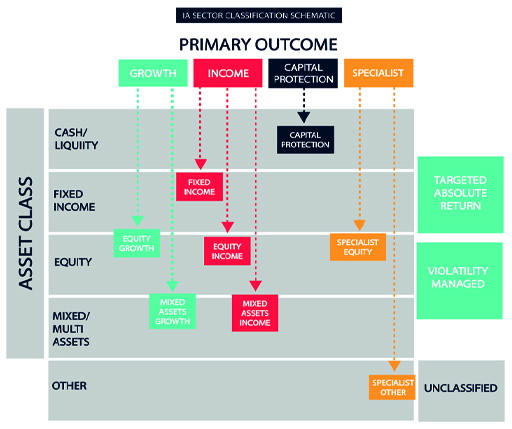

Figure 9 provides a classification of the different categories of investment funds.

You can find a larger version of this figure here: Larger version of Figure 9 [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)]

This array of different fund sectors provides the scope to pursue alternative strategies and objectives when managing investments. These include:

- Managing the split of investments between those that are expected to provide income and those expected to provide capital growth. With income and capital growth taxed separately, this enables investors to maximise the benefits of their tax-free allowances.

- Managing the extent to which investments are diversified. Risk-averse investors will tend to see funds that include a range of exposures to different industries or countries or continents. Investors who want to take the risk of focusing on individual sectors or geographic exposures, because of a view they have about the prospects of outperformance, can seek out specialist funds.

- Selecting between funds which are actively and cautiously managed, depending upon the appetite for taking risk.

- Using funds to manage exposure to different asset classes like gilts, corporate bonds, cash investments, property, commodities etc.

- Making decisions about the size of companies invested in. Investing in small companies tends to be riskier than investing in larger companies but the potential returns tend to be commensurately higher too. Why do think this is the case?