1.3 Investment planning needs a long-term perspective

You have now completed your review of savings and investment activity, with an emphasis on the UK. Clearly there is evidence of poor personal investment planning.

To avoid these pitfalls when it comes to our finances we now need to start thinking about how we should go about the business of effective investment management. Let’s build the foundations of an investment strategy.

Looking ahead – investment planning is a long-term activity

Investment planning means looking ahead – often a great many years ahead. Whether it is for a future major purchase or for retirement, the process of building up investments may take several years or even decades. This long-term time horizon requires us to assess a number of things.

First, it requires a forecast to be made of how inflation will affect the future cost of the item to be acquired or the level of income needed for retirement. When planning investments, it is crucial that inflation is taken into account (planning is done in ‘real terms’). This means that forecasts of future values should all be in terms of today’s money, so that you’re looking at what the money invested might buy after taking into account the possibility of price rises between now and cashing in the investment.

Second, the time horizon is vital in determining the structure of investments. If the horizon is the near future, there is little sense in investing in products that may fall in nominal value. The longer the time horizon, the greater the capacity to ride out periods when investments don’t perform well, in order to benefit from their gains over the medium to longer term.

Recalibration is also vital. Checking regularly (at the very least annually) that your investments are on track to achieve your goals is vital. If they are going off track then decisions may need to be made, including increasing the amount of current income diverted into investments (increasing the sacrifice of today’s spending to benefit from greater income in the future). Alternatively, the structure of the investment portfolio may need to be revised to improve expected performance over the chosen time horizon.

Even if you invest passively and let others (i.e. fund managers) look after the management of your assets, the responsibility for monitoring and managing the investment portfolio ultimately lies with yourself.

Filling the blank canvas

The planning process should involve:

- Starting with a blank canvas by not letting previous investment experiences and plans dictate what you plan to do now.

- Linking your investment plans to your life’s goals and the timing of these goals – for example, the time you expect your children to go to university and, consequently, require substantial financial support to ensure that they do not become over-indebted with student loans.

- Prioritising your goals. You cannot necessarily achieve all goals, particularly simultaneously, but you can have a list that comprises of ‘must haves’, ‘would like to haves’ and ‘would like to haves, if possible’.

- Taking into account that your investment planning is not a fixed plan that is set in stone. Rather, it is a living document that needs to be reviewed as circumstances change (which may increase or reduce both the need or the ability to invest for the future).

- Embedding investment activities into your life’s routines – for example, by setting up direct debits to make contributions to your investment funds monthly. This will avoid putting off, and perhaps ultimately not undertaking, investments that need to be made for the future. The default should be that you have to take action to stop investing, rather than having to take action to invest.

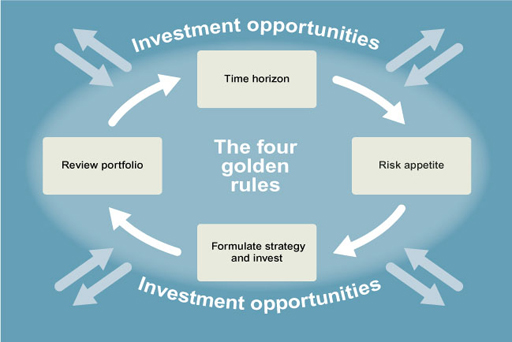

We can summarise this planning process through the four stage financial management model – a model that can be deployed for making all personal financial decisions including those relating to personal investments (Figure 10).

You can apply this financial planning model to your own decisions as you work through the course to help you build your investment strategy and compile your portfolio.