4.1.2 Cultural issues

Portfolio theory, which you may recall from last week, suggests that diversification is good for investors and it seems logical to suppose that investing internationally will improve the risk–return trade-off. Indeed, if we follow the Capital Asset Pricing Model (CAPM) to its logical conclusion, we should all be investing in the global equity markets in proportion to their market value.

Since the USA has by far the largest market capitalisation, investors, whatever their home country, should, in theory, be putting most of their money in the USA. However, in practice, there is home bias.

US investors tend to invest in US stocks, with very little invested overseas, and even the more internationally focused UK investor will typically invest the majority of their funds in UK equities. Part of the reason is that it is more difficult to invest overseas – some brokers will not let investors buy overseas stocks in small amounts, and information on shares is not so readily available, not to mention the fact that transaction costs are typically higher. An investor would also need a lot of money to gain exposure to all the major stock markets. As a result, small investors typically gain access to international markets through pooled funds, such as Open Ended Investment Companies (OEICs) or investment trusts.

Another difference is the span of investments that investment advisers typically cover. In the UK, investment advice is mostly on equities, pooled funds and some bonds. In France, however, the investment adviser will consider investment in property and stock-market investments as part of one portfolio – this is because tax advice is part of the investment adviser’s role and property can be a tax-efficient investment. In the UK, although tax advice is also important, stock market investment and property tend to be kept separate.

Some countries also have more of an ‘equity’ culture than others. British investors have been happily investing in global equities since well before the First World War. Bonds also fell out of fashion after the high inflation of the 1970s and 1980s. As a result, British investors have been relatively happier to invest in shares than other nationalities.

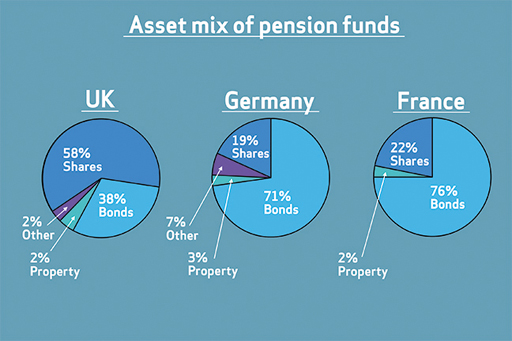

When comparing countries, there are important differences in how assets are combined into funds. Figure 2 shows the asset mix in 2008 for pension funds surveyed in the UK, Germany and France. Whereas, on average, pension funds in the UK had 58% of assets allocated to shares, in Germany only 19% had shares, and in France only 22% had shares. A much higher proportion was invested in bonds: 76% in France and 71% in Germany, compared to only 38% in the UK.