6.3.1 Prospect theory

A further major development in understanding individual behavioural biases came with Daniel Kahneman and Amos Tversky’s work on prospect theory. This culminated with Kahneman receiving the Nobel Prize for economics in 2002, bringing a greater awareness of behavioural finance in both the financial and academic communities.

Their collaboration on prospect theory further challenged the findings and reliance on classical finance. Prospect theory argues that, emotionally, the (adverse) intensity of a financial loss is an experience two to three times greater than the (positive) intensity for a gain of an equivalent amount. This can promote behaviour that avoids such an uncomfortable experience. This could include running loss making investments longer to avoid the adverse emotional feeling that transpires once the loss is realised by the disposal of the investment. Such behavioural forces can clearly have adverse consequences for effective investment management.

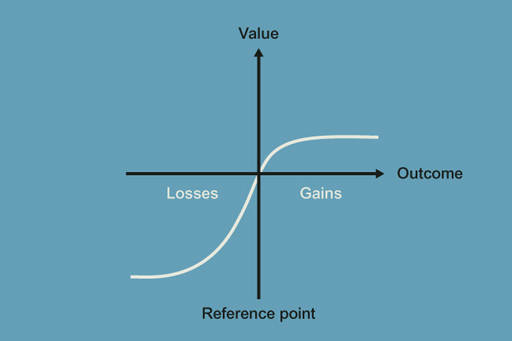

This proposition about the emotional reaction to gains and losses is depicted in Figure 6. As losses turn to gains the adverse emotional reaction (‘value’) turns from negative to positive, but note how the extent of the negative value is greater than the extent of the positive value for gains and losses of similar magnitude.

It is important for investment managers to acknowledge the presence of loss aversion in areas under their responsibility. As with all behavioural biases, it may trigger a shift in the motivations of decision makers away from rational and considered actions.

For example, an investor may, after extensive research, decide to buy a particular share. As part of their investment strategy, they will normally have good and carefully considered reasons to make the investment. They may have a target price to sell the asset for a profit. They may well also have a price point where they wish to limit their losses. One would expect the investor to reassess the investment if the economic conditions supporting the rationale for the investment changed. However, all too often, investors can stay invested in shares long after such conditions have changed and the investment is losing money. In these circumstances, loss aversion has taken over as the key influence of their decision-making. Investors may, in these circumstances, justify their behaviour in a variety of ways, but essentially their actions are being motivated by the avoidance of realising the loss.

Investors need to possess the appropriate skills to be able to identify when they could be subject to loss aversion.

Activity 6.2 Loss aversion and decision making

Can you think of a situation where you or a colleague have made a decision based on loss aversion?