1 Employment trends in STEM

When you are returning from a career break, especially if this has been for a number of years, new developments in science and technology may have led to changes in skills required in the workplace. So where might you be working when you return to STEM? In this section you will be looking at some key government and business reports about some expected trends in STEM employment.

Activity 1 Trends in STEM

Read through the government report called The Future of Work Jobs and Skills in 2030 [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] and make notes on what trends might be relevant for you in your STEM specialism.

Cogent Skills works across the science sector, representing Life Sciences (pharmaceuticals, biotechnology, medical technology and consumer healthcare), the Industrial Sciences (chemicals, downstream, industrial bio-technology, polymers, advanced materials and formulations) and Nuclear. The science-based sector comprises some of the UK’s most strategically important, value-adding and innovative employers in the UK. It provides for our energy and our healthcare needs as well as the raw materials for supply chains across every single area of industry.

Read the Cogent Skills report A Greenprint for Skills for the Low-Carbon Industries. How will issues of sustainability and climate change affect your future career choice, and what contribution can you make to a low carbon future?

Activity 2 Evaluating the statistics

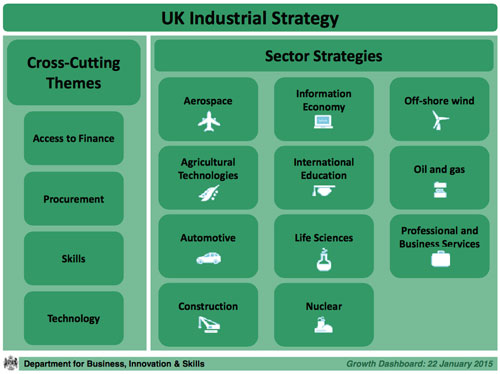

The Department for Business, Innovation & Skills (2015) Growth Dashboard shows the trends in a number of STEM occupational categories. It says that ‘in 2013, 32 per cent of vacancies were classified as skills shortage vacancies; an increase from 2011 levels’ (p. 32).

On page 29 of the dashboard there is a breakdown of the sectors shown in Figure 1.

Go to page 29 of the dashboard and select the sector or sectors most related to the area of STEM you have previously worked in. Make a note of the amount or percentage of UK GVA which the sector represents and the percentage or number of UK jobs it has. It is useful to take a look at pages. 29–44 of this government report and make notes on what you think are the most relevant trends in the area of STEM you are interested in.

Discussion

Specific employment and GVA facts are:

- Aerospace – 7.6 per cent of manufacturing GVA (4.6 per cent in 2000) and 4.3 per cent of manufacturing employment (2.9 per cent in 2000).

- The UK Agri-cultural Technologies sector – contributes £10.4bn to GVA and employs 475,000 people.

- Automotive – 0.7 per cent of UK GVA and 5.9 per cent of UK manufacturing jobs.

- Construction – 6 per cent of UK GVA and 6 per cent of UK employment.

- Information Economy – the chart shows that in 2013 there were 900,000 jobs in the sector in 2013 and £68bn GVA.

- International Education – the education sector exported £18.1bn in 2012, with the majority of this (65 per cent) coming from higher education. The number of European Union Higher Education students in the UK has risen by 13,140 between 2007/08 and 2012/13. Over the same period the number of non-EU students has risen by 70,330.

- Life Sciences – employs 176,000 people, with a £51bn turnover.

- Nuclear – sales in the nuclear sector were £3.96bn in 2011/12. There were just under 36,000 jobs in the nuclear sector in 2011/12.

- Off-shore wind – the sector could deliver up to £7bn GVA (excluding exports) and support over 30,000 full time equivalent UK jobs.

- Oil and gas – the UK oil and gas industry GVA is £24.0bn and directly employs over 25,000 people. Once the supply chain is included, the industry supports about 280,000 jobs.

- Professional and Business Services (PBS) – the chart shows that in 2013 there were four million jobs in the sector and £160bn GVA.

You have now looked at an overview of the trends in STEM and begun to consider how this is relevant to you. In the next section you will look at a specific area where there is employment; demand either through a skills gap or a growth in the sector.