7 Why pay taxes? Are you entitled to benefits?

You’ve learned about Income Tax and National Insurance in some detail. There are other taxes too, such as Value Added Tax (VAT), excise duties, Stamp Duty Land Tax (SDLT) and Inheritance Tax. All of these taxes raise revenue to pay for state benefits and services such as health, education, defence, public order and safety, protection of the environment and recreation.

Money raised in taxes goes a long way towards paying for the physical and social framework in which citizens live and work. This money is raised and spent collectively. It reduces the need for private expenditure. Without it, the costs of health, education and much of the infrastructure on which we depend for the smooth running of our lives would have to be funded entirely from private individuals and organisations. Our society would be very different.

State benefits account for a large proportion of government expenditure and represent important components of the welfare state. They have been built up in the UK over the last century or so to provide social protection against various risks such as unemployment, sickness or work injuries, and to ensure that financially poor and marginalised citizens have sufficient income.

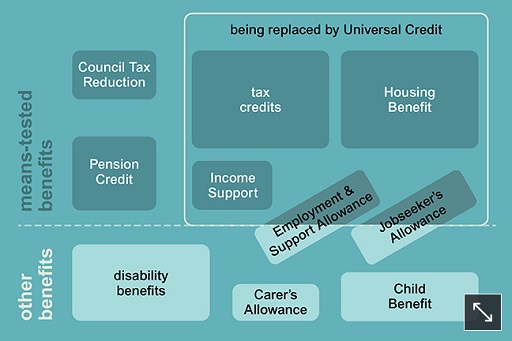

The Conservative/Liberal Democrat coalition government elected in 2010 introduced substantial changes to the benefits system. Its strategy was to partly replace the benefit paid to the unemployed (Jobseeker’s Allowance) and benefits paid to those in work but on low incomes (tax credits) with a new benefit called a Universal Credit. The diagram above summarises the benefits that Universal Credit is replacing. Employment & Support Allowance and Jobseeker’s Allowance are being only partly replaced by Universal Credit. The switch to Universal Credit is expected to be finally completed in 2024.

Other measures included restricting Child Benefit payments to households where neither parent is a higher rate taxpayer, placing a cap on Housing Benefit payments and putting an overall cap on benefits.

Until you reach 18 you’re unlikely to have any personal and direct entitlement to state benefits if you’re in full-time education. Depending on how much they earn, your parents may be able to receive Child Benefit for you. This is not payable to you personally. The benefit is intended to cover at least some of the costs of bringing up children.

Other benefits may be paid to your parents if they are on a low income, and these are linked, in part, to the number of dependent children they have. But, once again, any payments linked to children in a household will not be paid to you personally.

Once you become 18 or are no longer in full-time education you may gain entitlement to certain government benefits – for example to cover housing costs, or if you on a low income from work (in which case you could claim for Universal Credit). If you’re unemployed you could claim for Universal Credit and Jobseeker’s Allowance.

Activity 5 What’s the meaning of ‘means tested’?

In Figure 6 some benefits are categorised as ‘means tested’.

What is this about, and why is it applied to certain benefits?

Feedback

Benefits that are ‘means tested’ are linked to how much income (‘means’) a benefit claimant has. People who are considered to have sufficient income are not entitled to these types of benefit.

The two main reasons put forward for applying means testing are:

- it keeps down the overall cost to the government of providing state benefits

- it maintains the incentive to work. If it was possible to live comfortably on government benefits some people, at least, would be disinclined to work.