5 Comparison websites – not the full story

Comparison websites are a common part of making spending decisions, for example when you’re looking for the best deal on a phone or a new pair of trainers or car insurance. They’re also widely used to research utility services and e-services – to help choose between gas and electricity suppliers, and internet providers.

Comparison sites started to emerge in the 1990s, coinciding with the start of the internet.

They’re a way for customers to compare the costs and benefits of one company’s products against another’s. They provide a quick way to gain quotations from different organisations.

Most of them offer a choice between buying online and, less commonly, by phone. In effect, comparison sites are a form of intermediary: companies that supply the goods and services pay the owners of the comparison site each time one of their products is sold.

The strongest brands currently are:

- www.confused.com [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)]

- www.gocompare.com and

- www.moneysupermarket.com

The consumer advice organisation Which? also provides product comparisons:

To offer something different, there are firms that are making a virtue of not being on comparison sites by claiming that their products are cheaper as a result, such as Direct Line.

Taking an impartial overview, the financial services regulators have raised concerns about customers not getting the level of clarity they need to make decisions about which products to buy.

However, despite these issues, comparison sites continue to proliferate and grow in use.

Activity 3 Estimate their impact on markets

Think about the ways internet comparison sites affect customer behaviour, and the knock-on effect on the suppliers of the goods or services.

Now apply these ideas to the insurance market: what do you think might be the impact of comparison sites on the market for insurance products such as phone insurance?

Feedback

These websites make it easier for customers to shop around and therefore switch insurer on a more regular basis. This makes the market more competitive.

It also means that insurers are likely to have a higher turnover of customers, leading to higher costs – since it’s usually less expensive to keep a customer than to gain a new one. This in turn has led insurers to look at ways of driving down their operating costs – or, in some cases, at withdrawing from these comparison sites altogether.

Another impact is that some insurers have altered the structure and terms of their products to make them appear cheaper on the comparison sites – for example by heavy discounting, but for only the first year of insurance cover. In these cases the insurers hope that inertia will lead to a good proportion of customers not moving to new insurers after the end of the ‘cheap’ first year.

So while the sites are convenient to use it’s important that consumers remember to identify all the features and terms of competing products.

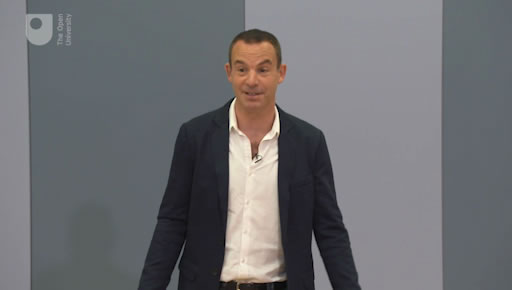

Comparison sites are a key driver for switching from one supplier to another. In this video Martin Lewis talks about the sense in being a ‘switcher’ instead of being a ‘loyal customer’.