3 The impact of compounding interest

You looked at a simple interest calculation in the previous section. But there are factors that can complicate the calculation of interest. For example, what would be the interest charge if some of the principal sum is repaid during the course of the year?

In many cases, the answer is that the interest rate calculation will be based on the average balance of the principal sum during the year.

For instance, if £10,000 is owed at the start of the year and £100 is repaid halfway through each month, then the outstanding balance at the end of the year will be £8800. This is £10,000 minus £100 for each of the 12 months of the year, or £10,000 minus £1200.

But the average balance of principal outstanding during the year will be the average of the balance at the start and at the end of the year. This is £10,000 + £8800 = £18,800/2 = £9400.

Based on this average balance, the interest for the year at 7% p.a. will be £658. The maths is (£9400 × 7/100) = £658. This is rather less than the £700 if no repayment of the principal sum had been made.

What happens if the borrower does not repay the interest due to the lender? Again, this will depend on the details of the contract with the lender and their attitude to borrowers who fall into arrears. Normally, the lender will add the interest charge left unpaid to the principal sum. This means that the following period’s interest charge is going to be higher since the borrower will be paying interest not only on the original principal sum but also on the unpaid interest. This is known as compounding, and can quickly enlarge debts.

Here’s an example of compounding.

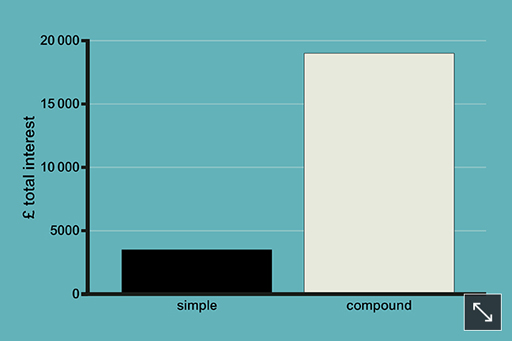

- What happens if someone borrows £1000 at an interest rate of 35% and makes no repayments over 10 years?

- Over this period of time the debt will rise from £1000 to £20,107.

- The total debt includes £19,107 interest on top of the £1000 borrowed.

As you can see, this is much more than if interest had been charged on a simple rather than a compound basis. Simple interest over 10 years would have been just £3500.