4 What are the costs of buying?

It’s a good idea to secure an offer of a mortgage before you put in an offer on a property. Once your offer on the property has been accepted you can proceed with the purchase. In addition to the deposit, this is where homebuyers rack up other bills as well.

Transcript

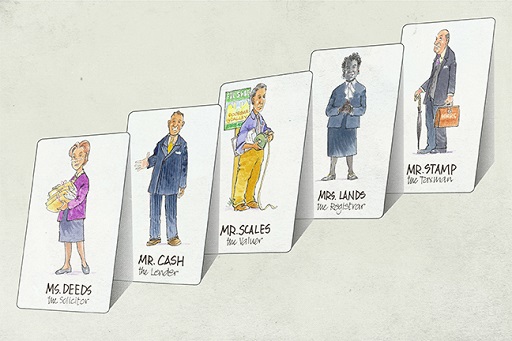

To show you how these costs might add up, let’s suppose you’re buying a property for £200,000. What additional costs do you incur? The animation leads you through the workings including:

- mortgage arrangement fee (common with fixed rate, capped and discounted mortgages)

- legal costs including local searches and Land Registry fee

- survey and valuation

- Stamp Duty Land Tax (SDLT): (note that SDLT is applied at different rates (or ‘marginal’ rates) depending on the value of the property). SDLT is levied in England and Northern Ireland. In Scotland the equivalent tax is Land and Buildings Transactions Tax (LBTT). The equivalent tax in Wales is called Land Transaction Tax (LTT).

- removal costs.

There might also be a fee to the mortgage broker if you’ve used one to help choose and organise the mortgage.

The largest cost will be the price of the property itself, which you, the buyer, can try to negotiate down from the seller’s asking price.

For the seller the only costs incurred in the list above will be legal costs and removal costs plus the cost of an energy performance report that sets out how energy efficient the property is.