3 Financial accounts

The term given to the day-to-day running costs and operational resources is ‘working capital’. A positive figure for working capital indicates that current assets (immediate cash and what is owed to the business) is greater than current liabilities (what is owed by the business). This will give a sense of security to suppliers and lenders. Working capital comprises cash held at the bank, the inventory (items held for re-sale) plus the cash due to be received from customers (receivables), less the cash due to be paid to suppliers (payables).

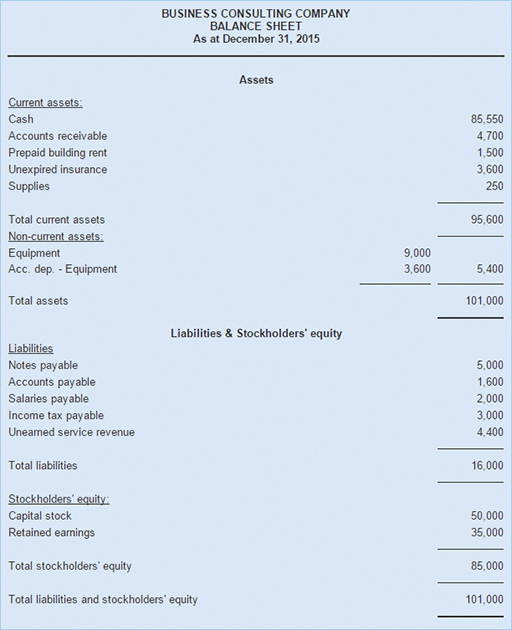

A balance sheet provides a summarised list of the assets and liabilities of a business, and its equity, at a particular moment in time. The terms are explained here:

- Assets – things a business owns, or money owed to it.

- Liabilities – financial obligations, or amounts of money the business owes to somebody else.

- Equity (sometimes called ‘net worth’) – the assets minus liabilities, that is, the total remaining value of the business after all obligations are taken into account.

Depreciation is an accounting term used to allocate the cost of an asset over an appropriate number of years, usually equal to the time period of its ‘useful life’. Therefore, on the balance sheet, fixed assets (like plant or machinery) may appear with declining value in successive years.

The balance sheet is an indication of the business’ financial health, which means its ability to pay its bills when they fall due. It shows its cash resources and how much debt there is in relation to equity.

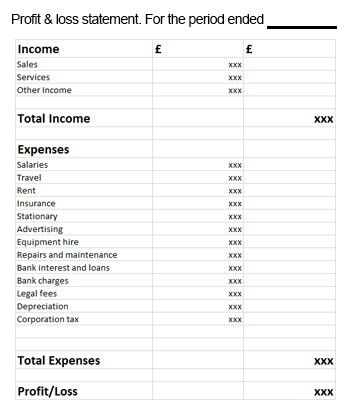

A profit and loss account (p&l), sometimes known as an income statement, shows how a business has performed over a period of time. It measures whether or not the business is economically viable. It pulls together the sales revenues and expenses for a specific time, for example over a year or a month,to show whether a profit or loss was generated.

The p&l (or income statement) shows the complete trading picture and business activities over time, including those sales made before the customers have paid cash for their purchases. As a result, expenses shown will include all costs and expenses incurred, including those for which the business may not yet have paid.

Sales revenue includes cash sales and sales made on credit terms. Cost of goods sold includes cash purchases and purchases made under credit terms.

The income statement is a basis for making business decisions and allows the business owners to see trends on sales, expenses and margins over time, and to make comparisons with previous periods and other similar businesses. It provides a basis for budgeting for the future.

Next you will look at limited companies.