2.1 Less economic growth

The resource curse is normally associated with poor economic growth. However, the effect of the curse is not only related to the amount of revenue generated by natural resources. Nigeria has over the past six decades accrued vast sums of wealth through crude oil exports and has consistently been Africa’s primary producer – over the past decade total annual revenue is estimated as between $20-40bn (OPEC, 2017). The key issue then is not just how much revenue is generated but, more importantly, how these rents are distributed – does the generated wealth disburse broadly across society and trickle down to the poorest? Two factors that can affect the pace of economic growth include:

- i.Price volatility and vulnerability – natural resource markets are prone to widespread and rapid fluctuations. Governments at the mercy of this uncertainty can find it very difficult to plan the economy effectively and may have to borrow heavily when prices slump. The reliance of the Nigerian economy on oil has made it notoriously vulnerable to price shocks. Falling global oil prices plunged the economy into recession in 2016, from which it is still struggling to recover (CSEA, 2017).

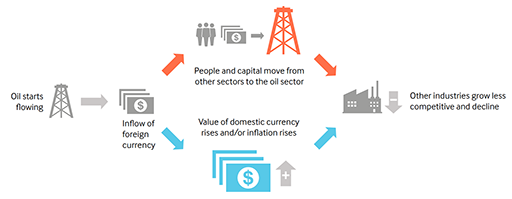

- ii.Dutch disease – this term was coined in 1977 by The Economist to describe the decline of the manufacturing sector in The Netherlands after the discovery of the Groningen natural gas field in 1959. Dutch disease occurs when the exportation of natural resources leads to a significant appreciation of the national currency. The currency appreciation has the effect of reducing the competitiveness of other export products by increasing the foreign currency prices of these products. At the same time, the currency appreciation may encourage massive importation of foreign products because they become cheaper in terms of the local currency and this also has negative effects on local industries. Otaha (2012) traces the decline of Nigeria’s agricultural sector as a result of volatile oil pricing and a consequent risk aversion to investment, which has made the country reliant on importing vast amounts of food.