6.2 A rational-economic perspective on risk

A rational-economic perspective generally represents risk as a combination of the expected magnitude of a gain or loss, combined with some probability distribution of anticipated outcomes. Economic ideas of risk behaviour are founded largely on expected utility theory. Expected utility theory predicts that investors will always be risk averse. The shape of the utility curve (utility plotted against increasing wealth) is such that utility increases with wealth, but at a declining rate. This is founded on the common-sense notion that I will value £100 less if I am very wealthy than if I am poor.

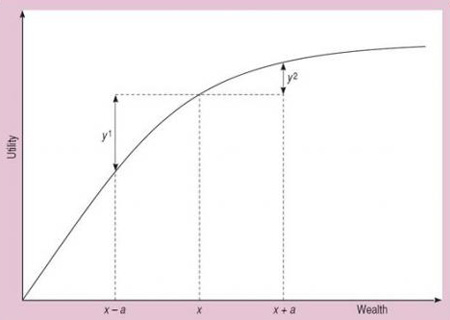

Figure 1 illustrates that (at any point x) the utility of an increase (+a) in wealth is less than the disutility of a decrease (−a) in wealth. This is used to explain why investors can be assumed to be risk averse. In a 50/50 gamble the disutility of the possible loss is greater than the utility of the potential win, so they will require a premium to engage in the gamble.

Thus, in economic accounts of market behaviour people are generally assumed to be risk averse and to require a ‘risk premium’ to accept a less certain outcome rather than a more certain outcome. Across a market, individual risk preferences aggregate to create a market price for risk.

Other simplifying assumptions, such as the idea of efficient markets, which instantaneously bring about market prices based on all available information, provide a basis for the construction of mathematically sophisticated approaches to understanding financial risks.

If you have studied financial strategy, you will know that there are a range of financial tools and technologies for managing financial risks, including portfolio management, options and the use of risk-adjusted discount factors and sensitivity analysis in discounted cash-flow calculations. The range and sophistication of such tools is increasing rapidly and there is no doubt that they have value. However, these tools are used by people (with all their biases and cognitive limitations) and assume a model of human behaviour (rational-economic) which is a significant oversimplification of how people really behave. For a brief review of decision science approaches to accounting for financial risk in decision making see Vlahos (2000).