4.2 External growth strategies: mergers and acquisitions

In the previous section you saw how a business can expand its capacity through capital expenditures. For example, going back to the increase in EasyJet’s capital expenditure, this will almost certainly increase the number of flights, and hence the overall capacity of the business.

Along with this internal or ‘organic’ growth, companies also have the option to grow ‘externally’. Typically, companies will search for a balanced mix of internal and external growth. Despite being a more complex growth strategy, it could represent an opportunity to those companies that have exhausted other ways of increasing the scope of their businesses. In this section you will be introduced to the most common ways to pursue this type of expansion, and also see how these are usually financed.

One of the key options available to companies willing to expand the business is via mergers and acquisitions (M&As). In a merger, two companies (usually a leading and a target one) agree to ‘amalgamate’ themselves into a new company, sometimes under an entirely new name. An acquisition happens when one company purchases another one. The purchased company could be entirely absorbed, thus ceasing to exist, or it could continue to function independently, sometimes also keeping its original name. Mergers can be generally classified into three groups:

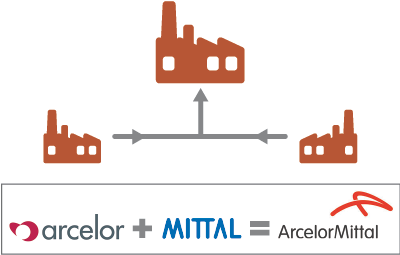

1. Horizontal mergers

Horizontal mergers are a combination of two companies operating in the same industry, offering very similar products and/or services, hence in direct competition with one another. For example, think about steel-producing giants Arcelor and Mittal Steel having merged in 2006 to create ArcelorMittal S.A.

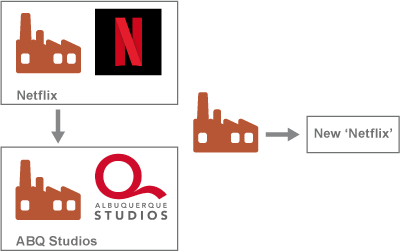

2. Vertical mergers

A vertical merger involves the acquisition of a company operating at different stage of the same supply chain. The post-merger company can expand in both directions, both towards the inputs for production or the final consumers. You might think of a manufacturer buying one of its suppliers. One of the many examples of this type of integration is the acquisition of ABQ Studios (film/TV production) by the streaming platform Netflix in 2018.

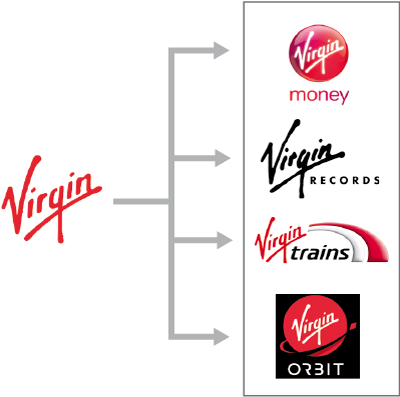

3. Conglomerate mergers

A conglomerate merger is where companies with totally unrelated lines of businesses combine. For instance, think of a record label buying a wholesale food store. One real-world example of an established conglomerate businesses is Virgin Group Ltd. Virgin Group’s activities span across music, banking, rail transport and aerospace services, among other things.

The three main types of mergers correspond to different purposes. In the end, the common motive for all mergers is to add value (i.e. how much the business is worth) by creating synergies – that is, fruitful collaborations. This is possible only if the two or more companies are worth more together than as single entities. There are five key sources of these synergies.

- Economies of scale: a company could become more competitive with respect to other players by increasing its size. The competitive advantage usually comes from the consolidation of business operations and from the reduction of redundant costs.

- Economies of vertical integration are available within the supply chain of a specific product or service. A company might try to control the production process by merging with a supplier of inputs or with a customer. In the last decades, outsourcing (obtaining goods or services by contract from an external supplier) has been the preferred option to establish this type of merger.

- A search for complementary resources is the motive behind a larger company merging with a smaller one. The two have what the other needs; usually the former can provide organisational and marketing skills while the latter has a unique product or service that needs commercialisation.

- Industry consolidations seek efficiency improvements via reducing the number of players in a specific sector.

- Companies, usually mature ones, might be in a situation which generates a stable and substantial amount of cash, but struggle to find profitable investment opportunities. Companies with surplus cash and no attractive investment opportunities might use these funds to finance a merger.