3.1 The stock and bond markets

A large portion of the capital market is represented by the stock market, where companies’ stocks are traded. Although the terms ‘stock’ and ‘share’ are nowadays used interchangeably, it is more appropriate to use the former when referring to the company as a whole (e.g. the stock of a manufacturing company), while the latter refers to the parts in which the company stock is divided.

Figure 4 below is a map showing the location and size of the top ten stock exchanges in the world. The size of a stock exchange is measured by the market capitalisation of its listed companies. It is easy to see how the USA, and especially the city of New York, currently dominates this type of market. In terms of market capitalisation, in 2018, the NYSE and the NASDAQ alone accounted for more than the other eight stock markets in the top-ten ranking together. Click on the locations to reveal information on each exchange.

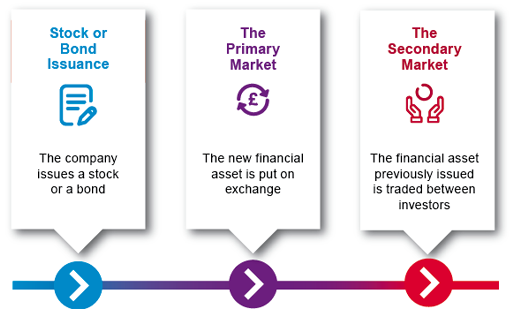

Primary and secondary markets

The stock and bond markets are sub-divided into primary and secondary markets. The primary market, or ‘new issue markets’, is where newly created financial assets (for example a company that issues a bond certificate or a stock) are put on exchange. The secondary market deals with the trading of previously issued financial assets, where transactions between investors occur. The secondary market is where the highest volume of trading takes place.

Over-the-counter markets

A special type of secondary market is the ‘over-the-counter (OTC) market’. In contrast to the stock exchange, OTC markets are not physically recognisable: they are better described as networks of trading relationships between dealers. Moreover, unlike exchanges, OTC markets are not subject to strict regulation about the quantity and quality of the assets traded, and all the contracts are bilateral, i.e. only between two parties. Given these characteristics, OTC markets lack transparency compared to the ones discussed so far.

Financial instruments, such as stocks, debt securities, derivatives, and commodities can be traded OTC. Typically, small companies lacking the resources to be listed on formal stock exchanges trade their stocks OTC. However, even larger companies might decide to trade their stocks OTC.

Activity 6 The basic structure of the financial market

The diagram below summarises the hierarchical structure of the financial market. Complete the diagram by clicking on the different components and adding your own definition for each. You should also think about the interaction between different elements of the financial market as you work through them.