1.1 Savings and investments

In Charles Dickens’s book David Copperfield, Mr Micawber infamously mused that an annual income of £20, coupled with an expenditure of £19, 19 shillings and sixpence (leaving sixpence over to save) was happiness itself. Whereas the result of spending £20 and sixpence (and having to borrow the difference) would be misery. Linking happiness or misery to having surplus income or surplus expenditure may be somewhat simplistic, but for many people having spare income, and thus an ability to invest for the future, can indeed help make life easier and more rewarding.

This course starts by looking at the importance of savings, why households save and invest, and the features of personal investment activity in the UK. We begin by defining some terms you are going to come across.

First, we want to draw a distinction between the definitions of saving and savings. Saving refers to a flow of money in a particular time period – such as putting money into a building society account. By contrast, savings (note the plural) are the current value of the total accumulated sum of previous saving. Savings are therefore the value of the stock of such savings that a household has at a particular point in time. Saving is connected to savings because saving in any given time period will add to the accumulated stock of savings. Consequently, if I already have £100 in a savings account, that £100 is my savings, but if I put an additional £25 a month into the account, I am saving £25 a month – after two months, my savings will have increased to £150 (plus any interest – the return paid on savings – earned).

We use the terms ‘saving’ and ‘savings’ in the same way as the UK Government’s official definitions, to encompass putting money into both ‘savings products’, such as deposit accounts, and ‘investment products’, such as shares, government bonds, and investment funds – including pension funds. However, you will notice that this section is called ‘Savings and investments’. This is because in personal finance a distinction is often made between the two with savings being associated with money held in bank and building society accounts, while investments relate to money held in shares, bonds and funds.

A key point about saving is that it defers (or puts off) consumption today in favour of consumption at some time in the future. This future may be a night out or holiday in the coming months or year, or even many years away in the case of a young person saving for retirement. Saving can even be for after death, such as when people save in order to bequeath or leave money for their children. This contrasts with the taking out of debt, which is bringing consumption forward by buying now and paying later.

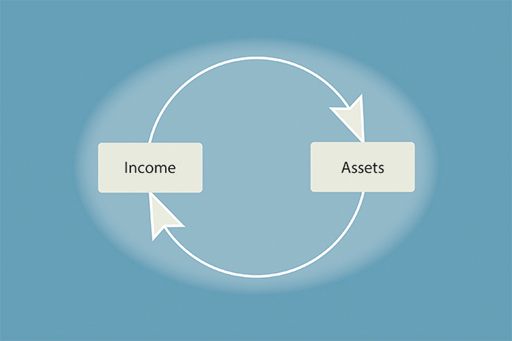

You should also note the relationship between assets held in the form of savings and investments and income. The receipt of income immediately adds to assets, for instance, when income is paid into a bank account. Such assets may only be temporary because the money is then used in the typical outgoings of a household, paying bills and living expenses, but any surplus income that isn’t used adds to a household’s savings and other assets. In turn, assets like savings usually produce an income in the form of interest on a savings account, for example. This interrelationship is summarised in the diagram above.

One other important point to note is that households often have debts and savings simultaneously – they are not mutually exclusive. For example, many households have a mortgage and a savings account. They can also be saving (for example, contributing to a pension fund) and taking on more debt (for instance, adding more to a credit card bill).