1.4.3 Why did the FTSE 100 behave like a rollercoaster in 2016?

There is no equation that formally links the factors set out in the previous section with the performance of share prices – at best, there are strong correlations at work. Yet all the major swings in equity prices seen in recent decades can be explained by the economic contexts defined by these factors.

Let’s try a recent episode out to test the theory!

Activity 1.4 FTSE 100

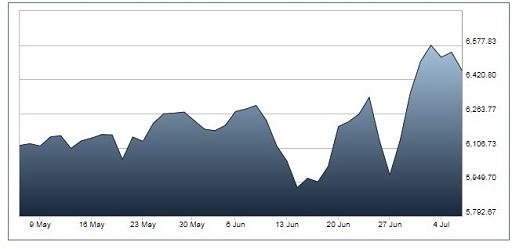

Have a look at the graph in Figure 18. It shows the movements in the UK’s leading share index, the FTSE 100, between May and July 2016.

Clearly this was a period of share price volatility with the index falling sharply in June only to stage a very strong recovery into July.

This period saw unremarkable activity in the economy with inflation and interest rates low and with economic growth steady.

So what caused the volatility and what led to investor sentiment first turning negative and then, very quickly, becoming positive?

Here’s a hint: referendum.

Discussion

The key driver of the volatility in the FTSE 100 was the referendum on the UK’s membership of the European Union (EU). This took place on 23 June 2016 and resulted in a vote for the UK to leave, with 52% voting for an exit versus 48% voting to stay in the EU. This was an outcome that was not expected by the opinion polls and hence it was a major ‘surprise’ to the public and the financial markets.

Ahead of referendum day the volatility in the FTSE 100 index reflected swings in the opinion polls but the actual result initially led to share prices, taking the index down in the process. The reason for the initial negative reaction was that the outcome was taken to be ‘bad news’ – at least in the medium-term – for the economy (although the actual impact of leaving the EU on the UK economy will only be known in the years after ‘Brexit’).

Within days, though, investor sentiment changed. This was because investors realised that many of the companies that comprise the FTSE 100 earn a significant (or, indeed, a major) proportion of their earnings in overseas (non-UK) economies. These overseas economies are not going to be directly affected by Brexit.

Additionally the vote to leave the EU led to a sharp fall in the value of the UK pound. This fall was forecast to have beneficial effects for many FTSE 100 companies since:

- the sterling value of overseas earnings (e.g. in US dollars) by FTSE 100 companies is increased

- those companies producing goods and services in the UK for export overseas would find it easier to sell them due to the fall in the value of the pound

- UK consumers, faced with a lower value for the pound, would be less likely to buy goods from overseas companies and would divert spending to UK companies.

So the initial adverse response of investors was quickly turned round as careful analysis replaced emotional sentiment in the assessment of the prospects for the FTSE 100 companies.

Brexit may be bad for many parts of the economy but this does not necessarily mean it is bad news for the FTSE 100. This index is a collective measure of the financial health of the 100 biggest companies listed on the London Stock Exchange – many of whom obtain a large portion of their earnings from overseas sales. The index is, therefore, not a wholly reliable measure of the overall health of the UK economy.