Challenge 2 Know your competitors

Competitor identification and analysis

This challenge is designed to encourage you to keep looking outside of your organisation to understand more about it by establishing the answer to the question - who are your competitors? Answer the following questions about your own organisation to the best of your own knowledge.

You can decide whether to consider the whole organisation, or to pick a business unit, a product range or an individual product or service. The important thing is to appreciate that organisations compete on many levels.

Hints and tips

To understand this more read the examples and tips 4, 5 and 6 [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] in the Hints and Tips section.

Don’t worry if you don’t know the answers to all the questions immediately. As with the previous challenge, your learning will be increased by knowing how many you can answer confidently, right now and then finding ways to answer the rest.

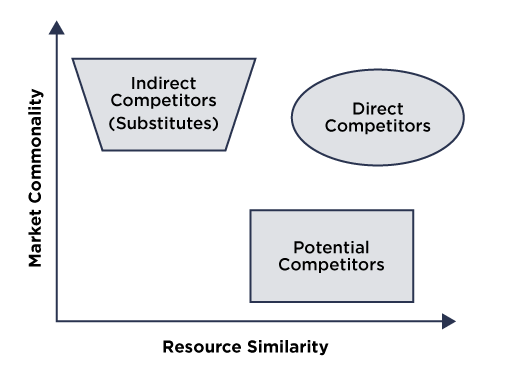

Figure 3 below may be helpful as a way of explaining how organisations can identify different competitors.

The Y axis in diagram 1 describes market commonality (that is where competitors are grouped according to the degree to which they meet the same or similar customer needs or wants). The X axis labelled resource similarity refers to the extent to which competitors have and apply the same resources to meeting those needs.

A couple of examples may help to expand on this. A competitor company that scored high on both axis (i.e. on the top right of the graph) serves the same need in the same way as your company does and so would be considered a direct competitor.

Consider these examples.

You have a hairdressing salon and you are competing with another hairdressing salon. There are mobile hairdressers who will go to a customer’s home.

In the travel sector, Easyjet is an airline in direct competition with Ryanair both offering low flights. Other airlines seek to charge more for a superior service offering and though the mode of travel and the destinations are the same, the experience is quite different.

Currently, Eurostar transports travellers to European destinations, but does not fly them. Eurostar have dissimilar resources but meet a similar need (to travel to a destination) and so could be considered an indirect competitor to the airlines.

The interesting challenge for many organisations comes from companies in the “potential competitor” grouping. As new technology start-ups threaten to disrupt many sectors, it is often technology that is producing a host of possible alternative business models that are disrupting the worlds of banking and financial services, retail, estate agencies, education, publishing and broadcasting, music and many more.

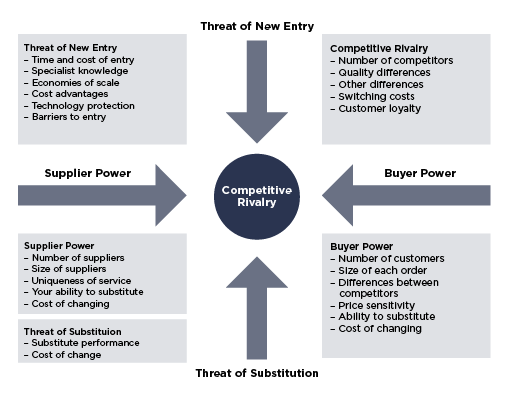

Figure 4 below is a useful way of taking the analysis of the competitive landscape in a sector or marketplace to another level.

Porter’s Five Forces Framework has been used for many years now to evaluate how competition arises and manifests itself in an industry or sector. It is designed to allow organisations to understand where there may be threats they need to respond to and how they can achieve a competitive advantage.

At one extreme, a monopoly supplier will have a very different profile to a company operating in a very fragmented industry with many alternative suppliers, potential substitutes for their products and services, and, therefore, choices for customers and end users. While it has been criticised for its simplicity, it has stood the test of time.

Now answer as many of these questions about your own industry or sector as you can. Take a note of those you need to check or explore further.

- Which other organisations do you consider to be in direct competition with you right now that supply the same products or services as your organisation?

- Do you know the size of the market place in which you operate in terms of either value or number of customers?

- Do you know what share of that market your organisation currently has and where it ranks relative to other competitors (e.g. is it the market leader?)

- Can you observe any trends in customer behaviour indicating that other organisations are competing indirectly with your organisation for similar products or services?

- From your analysis of the future impact in Challenge 1 Outside in where might future competitors come into the market place to challenge your organisation?

- Is competition getting more or less intense in your sector or market?

- If competition is either increasing or decreasing – do you know why?

- Is your organisation seeking to enter or leave a market or sector due to competitive forces?

- Is your organisation being threatened by an influx of new competitors?

- From the competitors you have identified, on what aspect of your organisation’s business model are they competing with you?

Now that you have worked through these questions, which of these do you need more information on to get to an answer?

Where might you find out more? There may be, for example, websites that produce industry reports and sector analysis.

Who in your own organisation has the answers to these questions? Could they point you to reports or organisations that you could use to investigate further?

Now you can go to Challenge 3 The business model.