10 Applying Steps 3 and 4 of the decision-making model to insurance

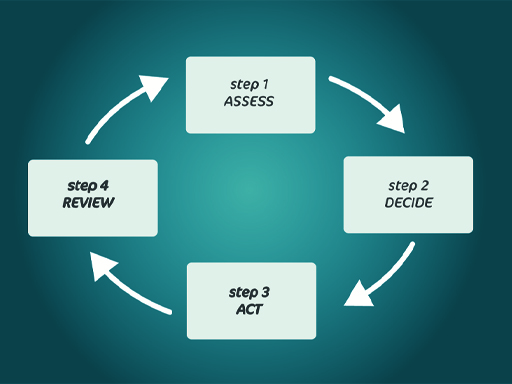

Now continue the process of applying the four-step model to insurance with Steps 3 and 4.

Step 3 is about acting to put the insurance plan into effect. This involves looking at the details of policies and comparing quotes to make sure you get the best deal.

As the UK’s insurance market is so developed, taking out most types of insurance is relatively easy. Insurance policies can be bought either:

- directly from an insurance company

- online, through price comparison websites

- via a third party, such as mobile phone shops that sell mobile insurance, or electrical retailers that sell ‘service and repair’ packages on their goods. Another example is travel agents or airlines that sell holiday insurance when you book with them, or

- through an intermediary (usually called a ‘broker’) who can use their knowledge of the insurance market to select the best policy for you from the ones offered by the companies it works with. Generally, the more complicated the insurance, the more an intermediary can help you in assessing your situation and needs, recommending and explaining policies, and in assisting in the event of a claim.

Whatever route you take to buy your policy, do take time to check closely the terms of the contract with your chosen insurer. Insurance policies are not identical. You need to ensure that the policy is right for you.

Step 4 is to ensure that you regularly review your decisions. When you review, check you still need the insurance – for example, if you’re unlikely to go on holiday in the next year, there’s no point in paying for travel insurance.

Always review your insurance needs when policies come up for renewal and when personal circumstances change (for example, if you have your first child, or when all your children are grown up and financially independent).

One of the worst things you can do in insurance is just renew with the same insurance provider year after year, rather than comparing every time your renewal comes up to see if you can get a cheaper deal with another provider.

As with any financial plan, check how things have worked out in the light of experience. This gives you the chance to remove ‘double insuring’ – to check that the same risk is not insured twice (for example, whether you are covered for legal expenses on both your car and home insurance), which would be unnecessary expenditure.

Activity 10 Applying the four-step model to insurance products

Having looked at how the four-step model can be applied to purchasing insurance – and reflecting on how you have done things in the past – are there any changes you will now make to the way you buy insurance cover?

Answer

Clearly your response is a personal one. For many people the main lesson learnt is to do the research necessary at the ‘assess’ step.

But many people do the assessment of the options available but then fail to decide what to do – perhaps because of the perceived complexities of choosing between alternative products.

A clear failing for many is to allow inertia to prevail and just accept the existing insurer’s renewal quote – which can be a costly option. Sometimes people find a better quote but simply fail to ‘act’ on it. Make every effort to avoid these pitfalls.