13 Understanding commodities

A further category of investments is commodities. This is where the investment is made in assets such as oil, gold and other metals or even agricultural products.

Generally there are two major attractions to these investments:

- The prices of commodities tend to rise during periods of price inflation. They consequently offer a ‘hedge’ against the risk that inflation erodes the real value of your investments.

- Commodity prices also often move in the opposite direction to other asset classes such as shares and property. Indeed, during periods of weakness in equity markets, investors are inclined to move to gold. As a consequence, investing in commodities can be an effective way to balance the risks on a portfolio also containing assets like shares and property.

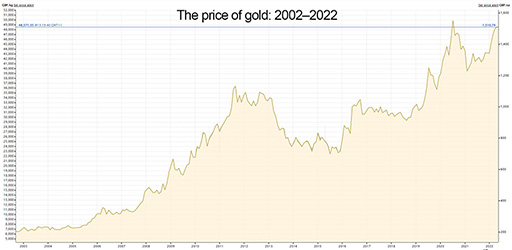

The other side of the coin, though, is that commodity prices can be volatile and are certainly at risk of periodic sharp falls. You can see this in the chart above which depicts gold prices between 2002 and 2022. In some ways, such investments have the same risk as investing in an individual share as opposed to investing in a balanced portfolio of shares.

How can investments in commodities be made? Three options exist for the ordinary investor.

First, where practicable, the investments can be made in physical form with the commodity itself being purchased and stored. This is feasible when it comes to commodities such as gold – witness the trade in gold coins. There is, though, insurance to be considered given the risk of theft or damage. Additionally, for the ordinary investor, stockpiling holdings of commodities such as oil or corn will simply be impracticable.

A second option is simply to buy shares in companies whose financial performance is most related to the underlying commodity you want to invest in. So mining companies’ shares are useful if you want to invest in defined metals; oil companies’ shares if you want to invest in oil. While this presents a straightforward way to get exposure to commodities this method of investment has risks. In many cases, the financial performance of such companies and the movements in their share prices are only loosely correlated to the commodities associated with them. The performance of major oil companies, for example, is linked to an array of factors – such as the taxation of petrol – which are unrelated to the price of oil.

The third option is to invest in funds that track the price of a specific commodity or defined basket of commodities. This can be done by placing money into exchange traded funds (ETFs). This way of investing in commodities allows you to customise and risk manage your exposure to commodities.