8 The 2015 pensions revolution: freeing up access to pension pots

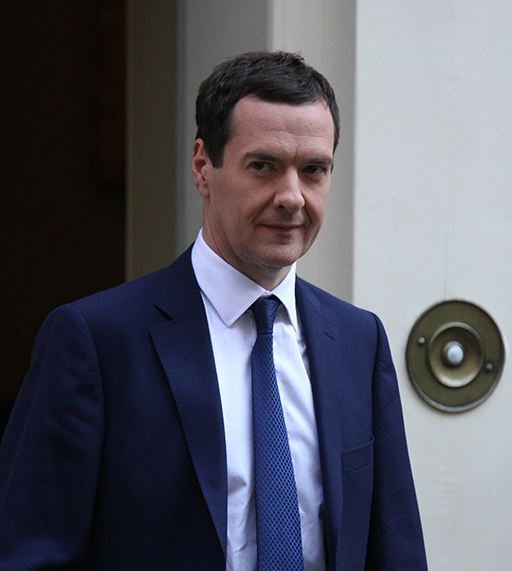

In his 2014 Budget Statement the then-Chancellor, George Osborne, unveiled proposals for pensions reform which have changed the financial options for those approaching retirement. These proposals took effect from April 2015 and have led to restrictions on access to pension pots being eased.

These are the key features of the pensions revolution:

The 2014 Taxation of Pensions Act provides greater freedom for those in ‘defined contribution’ schemes aged 55 years or more to access their personal pension funds (or ‘pots’). Basically, you now have many more options:

- Those retiring with defined contribution pensions now have alternatives to buying an annuity with their pension savings, though they can still do just that. On retirement, up to 25% of the fund can be taken as a tax-free lump sum (as previously applied prior to 2015) but you can still buy an annuity with the rest.

- What is new is that you can access the funds as cash to do what you want with, say, to invest in a range of assets (such as property) or to pay off a mortgage or other debts, or simply to finance current consumption. 25% of the funds accessed from the fund is tax-free. The rest is taxable as income and so could currently attract tax of up to 45% (for taxable income above £150,000).

- You can simply leave the money invested and draw down at a later date.

- There is also greater flexibility to pass on a pension to dependents after death. For those who die prior to the age of 75, income from pension assets can be passed on to beneficiaries tax-free provided this is done within two years of death. This tax treatment previously only applied to lump sums from a pension ‘pot’. For those who die aged 75 or over, normal income tax rates apply. Arguably, this reform removes an unfair excess tax charge on pension pots for which the deceased have spent their lives contributing to. An alternative view is that it provides a way to avoid inheritance tax, with those in retirement drawing on savings and other investments while leaving their pension funds untouched.

One key thing to remember whatever option is chosen is that pension income – including state pension – is liable to income tax. The good news, though, is that National Insurance Contributions (NICs) are not payable.

While the greater flexibility that these reforms provide for pensioners should be welcomed, a few concerns cannot go unmentioned.

First, one motivation for these greater freedoms seems, in part, to be the belief that annuities are poor value and, by inference, that other ways of investing pension funds may be better for pensioners. Yet while there have clearly been issues about how some insurance companies have sold annuity products, it is unfair to say that they are all poor value. The very low annuity rates prevailing a few years agosimply reflected growing longevity and, particularly, the then prevailing low interest rates. But with interest rates rising since 2021 annuity rates have moved up too. Currently (in 2024) – and depending on the features of the product – an annuity of around £7000 per annum is paid at 65 years of age for each £100,000 in a defined contribution pension fund (sharingpensions.co.uk, 2024). This figure applies to a single person. For a joint-life policy (i.e. for a couple) annuities are around £6,500 per £100,000 of a pension fund. In both cases these are fixed annuities with no annual increase to their level – something to think about at times of high price inflation.

Second, there are concerns that many pensioners will spend large portions of their pension pot and not invest the funds to provide the income stream needed in retirement. The risk is that within a few years, some pensioners will find themselves short of the income needed for a comfortable retirement.

Finally, there is a concern that the pensions industry is not resourced to deal with the advice required as a result of these wider freedoms now available to pensioners and those moving towards retirement.

Note, as mentioned earlier, that the minimum age for access to private pensions - and hence for the options set out above - is scheduled to rise from 55 years to 57 years in 2028.

Activity 7 Pros and cons of the revolution

What is your opinion of the new pension freedoms? Do you think the benefits outweigh the risks?

Discussion

Whilst it must be right to give people the right to use their pension funds as they see fit the risk is, for a small minority at least, these pension funds will be quickly exhausted, leaving pensioners with a poor quality of life in later retirement.

Financial services regulators are closely monitoring how the new freedoms are being used. There is certainly evidence of widespread access to pension ‘pots’ since 2015, but evidence too that the money withdrawn is being used rationally – like paying off any remaining mortgage, or buying further property to let out and generate rental income.