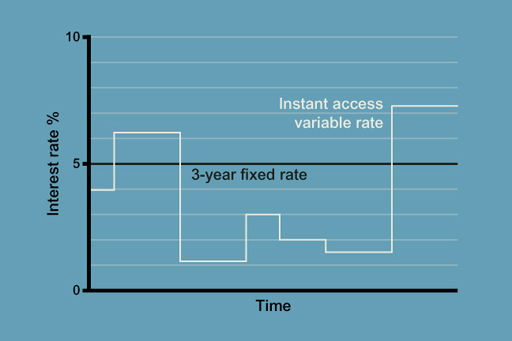

2.1 Variable rate and fixed rate savings products

Begin by listening to the audio, in which a young professional, Ryan, asks for help from personal finance expert Jonquil Lowe in finding his way through the many savings products on offer.

We join their conversation as Ryan asks about a savings product he’s come across called a ‘term bond’. The other savings options that are described are trackers, variable rate accounts and notice accounts.

Transcript

In addition to the products discussed in the audio, a new product, pensioner bonds, became available in 2015. The Chancellor, George Osborne, announced this new form of savings account in his 2014 Budget Statement. These first became available from January 2015 to those aged 65 years and over, with a cap on the investment of £10,000 per person per bond. Two pensioner bonds were offered: a 1-year bond offering 2.8% per annum (before tax or ‘gross’) and a 3-year bond offering 4% per annum gross. These returns, even after tax is deducted, were comfortably above the then prevailing rate of price inflation.

We looked at the impact of price inflation on investment earnings in Week 1, when we examined real interest rates. Index linked accounts are attractive to investors who want to guarantee that their savings are inflation-proofed.

In the UK, only National Savings and Investments periodically offers an inflation-proofed savings product in the form of index-linked certificates. For example, holders of the 48th issue five-year certificates are guaranteed to get their original investment (their ‘capital’) back at the end of five years with interest equal to inflation over the period plus 0.5% a year, in other words a real return of 0.5%. Someone who invested £1000 in these five-year index-linked certificates on the first date of their issue in May 2011 would, on 6 April 2016, have found that they had a valuation of £1172.80, giving a nominal return since the start of the investment of 3.3% p.a. once inflation had been added to the real return.

At times of low inflation, the return on index-linked investments can seem unattractive, but they come into their own in periods when inflation is expected to be high. Most savings products do not offer inflation-proofed returns.