2.3.3 Corporate bonds and their pricing

Corporate bonds are loans to a company that work in essentially the same way as government bonds. The main difference is default risk. While investors may be confident that a government will repay its loans, a company might not. To compensate for default risk, the return on corporate bonds is normally higher than the return on government bonds with a similar maturity – this premium is called the ‘corporate bond spread’.

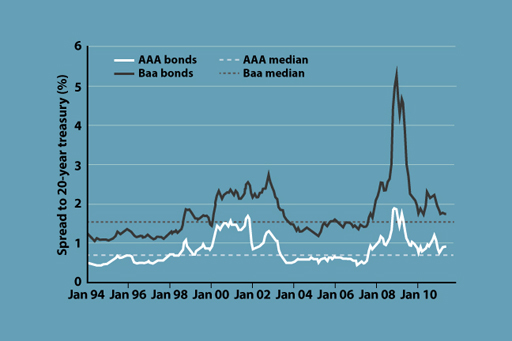

Figure 8 shows by how many basis points the return on different types of US investment-grade corporate bond exceeds the return on government bonds. A basis point is one-hundredth of a percentage point, so a spread of 100 basis points means a premium of 1 per cent over the return on a comparable government bond. During 2008, spreads widened dramatically, especially for banks and other companies in the financial sector. For most of the preceding decade, the spread was generally between 50 and 150 basis points (Bank of England, 2008, p.11). By 2009, the spread for financial sector bonds had widened to nearly 800 basis points. This wide spread reflected the global financial crisis and fears of an ensuing recession, indicating investors’ perception of an increasing risk of companies defaulting and high uncertainty about the future of the economy and investment markets.

After 2009 spreads started to narrow again as some semblance of calm returned to the financial markets. Few investors, personal or professional, have the time or means to investigate the credit worthiness of a company. One way to deal with this information gap is to refer to a credit rating agency, an organisation whose business is assessing risk and disseminating this type of information. The list below shows the rating scale used by one of the main international agencies. Personal investors will normally be looking only to invest in ‘investment-grade’ bonds, as defined in the figure. At the top end of the scale, a company assigned a ‘AAA’ rating is thought very unlikely to default on its bond payments, but this is not a guarantee or seal of approval – there is still some risk. The extent to which investors can and should be able to rely on the information from credit reference agencies is discussed later.

General summary of the opinions reflected by Standard and Poor’s credit ratings

Investment grade

AAA – Extremely strong capacity to meet financial commitments. Highest rating.

AA – Very strong capacity to meet financial commitments.

A – Strong capacity to meet financial commitments, but somewhat susceptible to adverse economic conditions and changes in circumstances.

BBB – Adequate capacity to meet financial commitments, but more subject to adverse economic conditions.

BBB– – Considered lowest investment grade by market participants.

Speculative grade

BB+ – Considered highest speculative grade by market participants.

BB – Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions.

B – More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments.

CCC – Currently vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments.

CC – Currently highly vulnerable.

C – A bankruptcy petition has been filed or similar action taken, but payments of financial commitments are continued.

D – Payment default on financial commitments.

Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (–) sign to show relative standing within the major rating categories.

(Standard & Poor’s, 2009)