6 Mortgages: understanding and managing the risks

It is important to reflect on the risks that arise from home ownership and having a mortgage. Being alive to these risks means that even when you cannot take action to eliminate them, you are at least better prepared to handle the consequences of them.

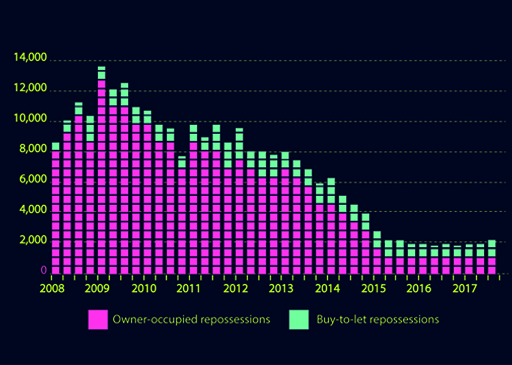

Mortgages are secured loans, so there is the risk of losing your home (via repossession by lender) if you default on repayments.

In recent years, mortgages have been very affordable due to the historic low levels of interest rates. But future years will virtually inevitably see higher interest rates return.

Mortgage lenders are required by their regulators to work with borrowers who get into financial trouble with their mortgages. But they could eventually repossess the property of a defaulter if it doesn’t get resolved.

Then there is the reality that house prices do go up and down over periods of time – although admittedly the trend line since the 1970s has clearly remained upwards. The future is, though, uncertain. There is the risk of finding yourself in negative equity (where the market value of your property is less than the remaining mortgage on it) if you buy at times just prior to one of those periodic falls in property prices. Provided you can still afford to meet your mortgage repayments, being in negative equity by itself is not a problem, though, unless you have to move home. In these circumstances you may need to find the difference between the market value of your property and the mortgage amount you have to repay.

Another risk seen very recently is that those who obtained mortgages under old affordability testing rules cannot obtain the same size of mortgage under the rules that have applied since 2014. These people are at risk of being ‘mortgage prisoners’, unable to take advantage of better mortgage deals as it means submitting themselves for a re-appraisal of the size of mortgage they can afford.

Interest rate risk is pervasive for all mortgages – you may lose out by taking a fixed-rate deal only for interest rates to fall. Or you take out a variable rate deal and interest rates rise.

And there is always the risk of inertia – for example, not taking action (or at least reviewing the mortgage market) when your initial mortgage deal ends and you are placed on your lender’s reversion rate (usually its unattractive SVR).

The other risk is not looking ahead and planning for life’s uncertainties – those events which will affect your household budget and put pressure on your ability to make your mortgage repayments. These could include breaks in employment, marital breakdown, illness or simply unexpected repair bills on your property.

This may sound like home ownership brings doom and gloom – far from it, as most people repay their mortgages without issues. But being forewarned and planning accordingly can minimise the risk of these issues causing you a problem.

So now it’s time for you to assess how you feel about the risks associated with mortgages and home ownership with this final activity.

Activity _unit5.7.1 Activity 6 Your perspective on the risks of home ownership and mortgages

In Table 2 below are the risks relating to home ownership and having a mortgage.

In each case select whether you have no concern, some concern or great concern about these risks and what you think you can do to manage these risks.

If you don’t have a mortgage right now, imagine you’ve bought a home and think how you’d feel in these scenarios.

Enter your comments in the boxes in the table and save to reveal the discussion.

| Risk | Concern and comments |

|---|---|

| Having my own home is likely to result in me having expenses – like repairs – that I may find difficult to afford. | |

| My income could make it difficult to keep up with my mortgage repayments. | |

| House prices could fall, pushing me into negative equity. | |

| The rules on affordability may change making it difficult for me to remortgage to a new deal – leaving me on a bad mortgage deal. | |

| I could make a poor choice of mortgage product, for example a fixed-rate deal when interest rates fall or a variable rate deal when interest rates rise. | |

| After my existing mortgage deal ends the reversion rate is the SVR which is unattractively high. | |

| I’m falling behind with my payments and I’m worried that my home will be repossessed by my lender. |

Discussion

| Risk | Comment |

|---|---|

| Having my own home forces me to have expenses – like repairs – that I may find difficult to afford. | Preparing for this means drawing up and managing a household budget and building in some financial room for manoeuvre to cover contingencies. Set up a ‘rainy day’ savings account too. |

| My income could make it difficult to keep up with my mortgage repayments. | Are there ways of increasing income (a part-time job, maybe?). Talk to your lender too to see if you can take steps to reduce your monthly mortgage payments – e.g. by extending the term of your mortgage or switching to a better deal. Note that there may be administration fees involved in doing this. This will depend on the policy of the lender. |

| House prices could fall, pushing me into negative equity. | If you can afford your mortgage payments, then you are OK unless you have to remortgage, for example if you have to move home due to a job move etc. If you do have to move, then you may need access to other funds to repay the mortgage outstanding after the proceeds from the sale of your home. |

| The rules on affordability may change making it difficult for me to remortgage to a new deal – leaving me on a bad mortgage deal. | A tricky one. Campaigning is taking place to help people caught by the affordability rules change. Maintaining an unimpaired repayment record with your current mortgage could help if you find that you do have to submit yourself to a new affordability test under the new rules. |

| I could choose the wrong mortgage option, for example a fixed-rate deal when interest rates fall or a variable rate deal when interest rates rise. | This happens to most people at some point in the years of having a mortgage. No one has a crystal ball when it comes to interest rates. Just be prepared to switch to a new mortgage deal if it looks as though it will save you money. Be proactive and keep an eye on the media and what is being said about the likely future direction of interest rates. |

| After my existing mortgage deal ends the reversion rate is the SVR which is unattractively high. | Don’t just sit there, do something! Check out the market and move to a better deal, and if that is with a new lender then so be it! Again, there could be administration fees but your current mortgage paperwork will confirm this. |

| I’m falling behind with my payments and I’m worried that my home will be repossessed by my lender. | Start a dialogue with your lender – they are required to work with you at times like this to avoid matters getting worse. Be prepared to seek advice from organisations like Citizens Advice and StepChange. |

It is now time to check what you have learned in the end-of-session quiz.

After that it is time to wrap up the session!