12 Understanding bonds

The other main kind of financial investment product is a bond, which can be issued by companies or governments. Bonds are also referred to as ‘fixed interest’ investments.

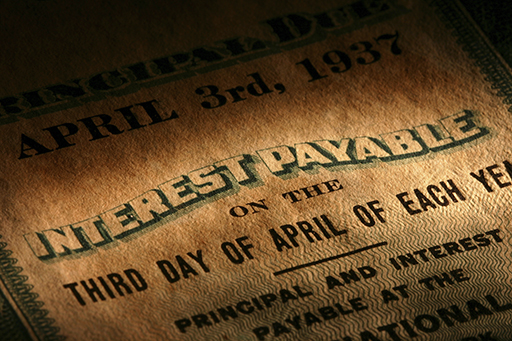

A bond is a loan made by an investor to a borrower (typically a company or government). You buy a bond with cash and the borrower promises to repay the money invested on a set date. The borrower also pays you interest on defined dates (usually annually) during the life of the bond. The interest rate is normally fixed, for instance, at 2% or 5% per annum.

Bonds have a ‘nominal value’ – this is the amount on which the interest is calculated and can be divided into small amounts for sale, usually £1000 or less. For example, an investor could buy £100 nominal of a ‘five-year 5% bond’. This will pay 5% a year for five years on £100 nominal – that is, £5 a year. The interest may be paid quarterly, semi-annually or annually, depending on the type of bond bought. At the end of the five-year period, an investor would receive £100 in repayment of nominal (or ‘face’) value.

Bonds tend to be less risky than shares because they have a promised interest rate, and because company bondholders rank in front of company shareholders in the event of a company being liquidated.

Although less risky than shares, bonds are riskier than savings accounts. This is because with savings products, typically the amount of capital you receive back is fixed – if you deposit £100, you get £100 back (plus interest).

With a bond, if it is sold before maturity, then more or less than the promised nominal amount may be paid. Whether it is more or less will depend on movements in the level of interest rates after the bond has been issued. If interest rates fall, the market value of an earlier issued fixed-rate bond will rise since it offers investors an interest rate higher than that currently being offered on newly issued bonds. The reverse applies if interest rates rise.

An additional risk of bonds is, if the issuer of a bond goes bust then you normally have no protection and may lose your investment. However, UK government bonds, known as gilts, are seen as safer than bank and building society accounts, as the government is even less likely than a bank or building society to default.

Bonds can be bought through stockbrokers or, in the case of gilts, through a special Purchase and Sale Service organised by the Debt Management Office (DMO), the government department responsible for issuing government debt.

One important note before we move on: some bonds that are advertised as being ‘long-term savings products’ may well involve shares or other forms of investment, and so their value can go down as well as up. These types of bonds are not like the savings products you looked at earlier. They can be very risky. So beware and read the details closely to avoid being misled!