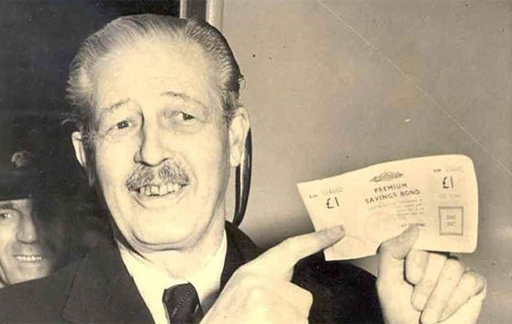

3.1 What about Premium Bonds?

The nation’s most popular way of saving is through buying Premium Bonds, operated by National Savings and Investments (NS&I) – which is backed by the government. Because of this, your money is protected in full.

Despite the term ‘bond’, they are a form of savings. But instead of earning interest, your bonds are entered into a prize draw each month where you can win up to £1 million. Each bond costs £1 and the minimum you can put in is £25, while the maximum is £50,000.

The prize money paid each year equated on average (in May 2020) to 1.3% of the total amount held by all savers in premium bonds. Whilst you may win £1 million (hardly anyone will, of course) or nothing, this average is useful to compare with the interest rates paid on savings accounts. However, most people earn even less than that average as the million pound prizes are built into it which takes up huge chunks of the overall pay-outs. It means that for most people, you are more likely to get a higher return in a normal savings account than in Premium Bonds, based on average luck, given you can normally earn more than 1.3% elsewhere.

If you win anything, Premium Bond prizes are tax-free. That may appear a big boon but 95% of people don’t pay tax on their savings anyway.