1.4 Try the bad habits test

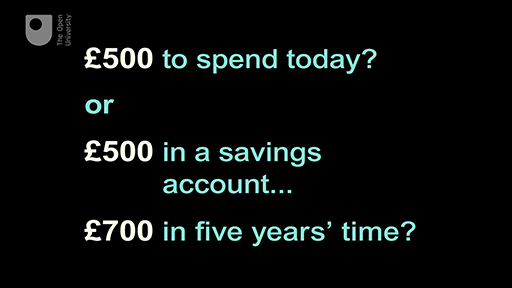

As you heard earlier from Mark Fenton-O’Creevy, there are good reasons why we sometimes make bad financial decisions, even if we’re pretty smart about most other things in life.

Find out if you’re suffering from some of the factors that make personal financial choices particularly difficult – perhaps we should call them the ‘perils of personal finance’.

Transcript

You’re almost at the end of the first week. When you’ve explored your bad habits, see what you’ve learned so far in the first test.