7.3 Planning ahead for your pension

How well are you preparing for retirement? Are you sure you can afford to retire with your current pension plan?

Most UK adults will already have some pension arrangements in place, not least because some are compulsory. Most employees and self-employed people have to pay National Insurance contributions and so build up a basic state pension. Most employees must also build up a state additional pension or a contracted-out occupational or personal pension instead. People may also have opted voluntarily to build up additional retirement savings.

The next stage in the financial plan is to check what arrangements are already in place, how much pension these arrangements are expected to produce by the chosen retirement age and whether there is a need to save extra. This is done by gathering forecasts and statements for the various arrangements.

Fortunately, these statements must all provide a forecast of the possible future pension in terms of today’s money, which helps with planning in real terms. The expected pensions can then be deducted from the target retirement income to see if the existing arrangements are likely to produce enough income.

If there is a shortfall, extra pension savings may be required if the retirement income target is to be met. There may be a tension between the amount a person needs to save and the amount they can afford to save given their current budget. In that case, either the retirement target will have to be revised or adjustments made to current income and spending via the budgeting process.

To see how the process of planning works in practice, return to the example of Dibyesh. He’s 37, thinks he should start saving for retirement, and so follows the initial steps of the financial planning model.

Stage 1: assess the situation

The first step is to decide how much retirement income he might need. Dibyesh currently spends about £480 a week and, thinking about how his spending needs might change in retirement, he reckons he would then need about £260 a week in today’s money.

Allowing some adjustment for tax, that would mean a before-tax retirement income of, say, £275 a week or about £14,400 a year based on current tax rates. This is around 50% of his current gross income.

Stage 2: decide on a financial plan

Based on the changes to the state pension system introduced from 2016, Dibyesh expects to get the full flat-rate pension, equivalent to £164.35 a week (£8546 a year) from his state pension age of 68.

Currently, Dibyesh has no other retirement savings. He needs a plan to produce another £5854 a year of pension to generate that target pension income of £14,400 a year. He is self-employed, so there is no occupational scheme to join. Therefore Dibyesh looks at a personal pension.

The pension provider helps Dibyesh to work out that to produce a pension of £6500 a year by age 68, Dibyesh needs to start saving about £250 a month, assuming he increases this each year if his earnings rise. This means Dibyesh will need to save about 12% of his net income year after year. He is already saving some of his income each month but this is earmarked for other things. To save enough for retirement, Dibyesh decides he will have to cut back his current spending.

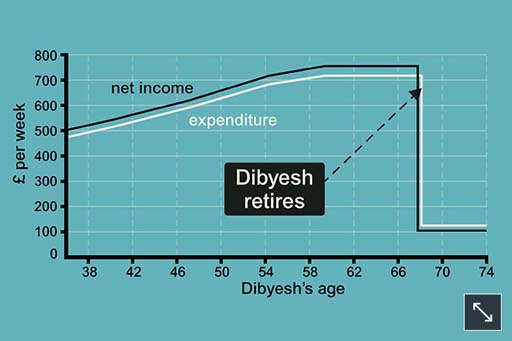

Without retirement savings, Dibyesh’s income drops very sharply once he reaches age 68 and his budget is so stretched that his spending actually exceeds his retirement income.

Stage 3: act

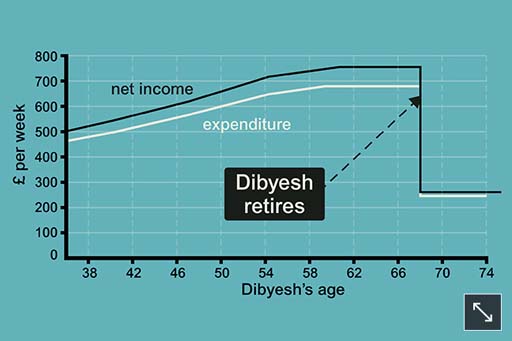

If he saves for retirement, his spending between the ages of 37 and 68 is reduced, but at age 68 the drop in Dibyesh’s income is much smaller and his retirement income is enough to cover an enhanced level of spending.

Dibyesh decides that giving up some spending today is a worthwhile trade for a better standard of living when he retires.

Later this this week you see how Dibyesh completes Stage 4 of the financial plan by reviewing his arrangements.