3.1.4 Jenny’s budget (Stage 1: assess the situation)

As you’ve already identified, Jenny is spending more than her income and needs to get her money management under control. This is Jenny’s immediate purpose in preparing her budget.

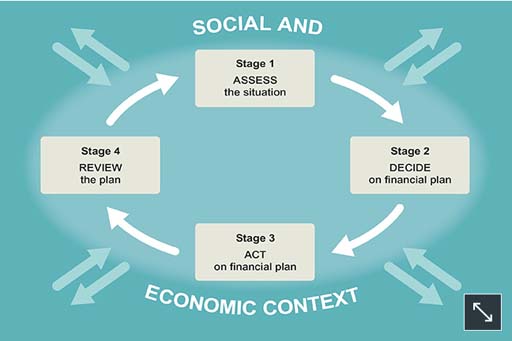

The approach to budgeting that you start here is once again the four-stage financial planning model. The start of the budgeting process could be described as the ‘reality check’, beginning with a cash flow statement.

| Cash flow (£ per month) | Average month (£ per month) | Budget (£ per month) | ||||

|---|---|---|---|---|---|---|

| NET INCOME | ||||||

| Earnings | Total 1115 | Total 1115 | Total 1115 | |||

| TOTAL NET INCOME | 1115 | 1115 | 1115 | |||

| Rent | 250 | 250 | 250 | |||

| Council Tax | 50 | 50 | 50 | |||

| Regular bills (gas, electricity, water, etc.) | 30 | 60 | 50 | |||

| Telephone (mobile and landline) | 40 | 40 | 30 | |||

| Home insurance (contents and building) | 12 | 12 | 10 | |||

| Household goods | 15 | 30 | 30 | |||

| Food and non-alcoholic drinks | 150 | 150 | 120 | |||

| Alcohol | 40 | 40 | 40 | |||

| Tobacco | 30 | 30 | 0 | |||

| Clothing and footwear | 50 | 50 | 40 | |||

| Medicines, toiletries, hairdressing (personal) | 30 | 30 | 30 | |||

| Going out | 120 | 120 | 80 | |||

| Holidays/other leisure | 20 | 100 | 50 | |||

| Motoring costs (insurance, petrol) | 70 | 130 | 180 | |||

| Birthday presents/charity/other gifts | ||||||

| Christmas presents/gifts | 10 | 45 | 30 | |||

| Personal loan repayments | 100 | 100 | 100 | |||

| TOTAL EXPENDITURE | Total 1017 | Total 1237 | Total 1090 | |||

| SURPLUS/DEFICIT | 98 | -122 | 25 | |||

Last week you looked at the income flows of a household. Now, the expenditure side of the cash flow statement will be added to see whether expenditure is less than, more than, or equal to income.

This statement provides a snapshot of the income and expenditure of a household during a particular week or month. A month is the time period used here for Jenny’s budget, but the process is the same whatever period is chosen. When you’ve added expenditure you’ll look at why this cash flow statement might not be giving the whole picture.

A system of keeping and carefully filing all bank and credit card statements will help you to collect information on how your money is being spent: in other words, you will have a record of all your debit card transactions, direct debits, standing orders, and goods and services bought on credit. However, to obtain a full picture of how your money is being used, it’s a good idea to keep a spending diary that records all cash transactions.

Once all such information about expenditure has been collected, you need to classify it under different headings of expenditure. The level of detail to include and how broad the headings under which expenditure is classified are personal choices. Nevertheless, it’s important to have some different headings if the budget is to be useful when thinking about change.

Individual circumstances will influence this decision, as well as the amount of detailed information available to record transactions. For instance, if you go out frequently, you may want to have a detailed set of headings for specific areas of ‘going out’ – such as meals out, cinema, the pub, lunch, going to football … Amounts under the different headings can then be recorded on the cash flow statement, alongside the income section described in Week 2.

In the table you can see the various parts of budgeting on one sheet. For convenience, it groups all three parts as three columns together: the first shows the cash flow statement for a particular month, the second shows average monthly expenditure and the third shows the budget. Start by considering Jenny’s cash flow statement for May 2018 – the first column.

The income side of the cash flow statement for Jenny is straightforward, as her only income is from her salary. If she had other earnings or you were considering a household with more than one person, then there would be different sources of net income, which should all be recorded.

Jenny’s cash flow statement doesn’t seem quite as bad as might have been anticipated from the graph, which showed expenditure being consistently higher than income for several years. In fact, in May 2018 she has a surplus of £98. You know this because her net income was £1115 and her expenditure was £1017, leaving £98.

How accurate is Jenny’s cash flow statement?

Take another look at Jenny’s cash flow statement. Can you think why it might not give an accurate picture of how Jenny spends her money over a whole year?