4.2.1 Types of interest rate

Interest rates can be set in a number of ways.

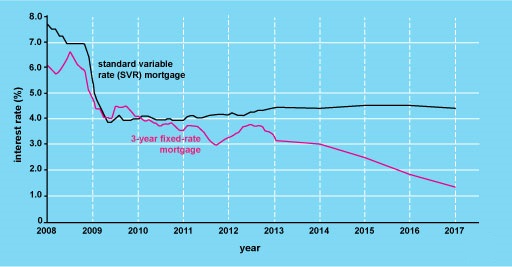

- A variable rate, which can move upwards or downwards during the life of the loan. In the UK variable rates usually move in tandem with movements in the official rate of interest. Some products (called ‘trackers’) are specifically linked to specific rates of interest such as the official Bank of England rates (Bank Rate).

- A variable rate with a ‘floor’. This is the same as a variable rate except that the rate cannot fall below a defined minimum level, known as the ‘floor’.

- A fixed rate where the rate is determined at the start of the loan and remains unaltered throughout the fixed-rate term. The rate will be based on what the lender has to pay for fixed-rate funds of the same term.

- A capped rate where the rate cannot rise above a defined maximum (the ‘cap’), but below this ‘cap’ it can move in tandem with movements of official interest rates. A variation to a capped-rate loan is a ‘collared’-rate loan where rates can move in line with official rates but cannot go either above a defined maximum (the ‘cap’) or below a defined minimum (the ‘floor’). Such products usually require the payment of a fee to the lender at the start of the loan.

Most commonly, personal loans are set at a fixed rate; credit card debt and overdrafts are set at a variable rate; while mortgage lending is split between the four interest rate forms defined above.

Households with variable-rate mortgages are, along with most of those with credit cards and overdrafts, at risk from increases in interest rates. As mortgages account for a large proportion of personal debt, it is easy to see why the UK economy can be easily affected by even relatively small movements in interest rates.

You will explore mortgages in detail in Week 6.