5.3.5 Bonds (fixed interest investments)

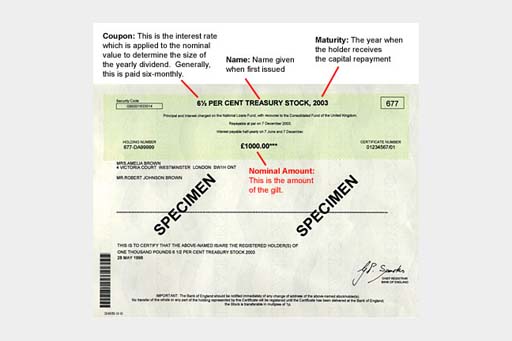

A bond generally represents a promise to pay a regular rate of interest over a fixed period, from one to 50 years, plus the promise to repay the nominal value (also known as the face value) of the bond (say, £100) on the maturity date. The interest rate is normally fixed, for instance, at 5% or 10% of the nominal value each year.

The nominal value is the amount on which the interest is calculated and can be divided into small amounts for sale, usually £1000 or less. For example, an investor could buy £100 nominal of a ‘five-year 5% bond’. This will pay 5% a year for five years on £100 nominal – that is, £5 a year. The interest may be paid quarterly, semi-annually or annually, depending on the type of bond bought. At the end of the five-year period, an investor would receive £100 in repayment of nominal (or ‘face’) value.

Bonds tend to be less risky than shares because they have a promised interest rate and because company bonds rank in front of company shares in the event of a company being liquidated. Although less risky than shares, bonds are riskier than savings accounts. This is because with savings products typically the amount of capital you receive back is fixed – if you deposit £100, you get £100 back.

With a bond, the amount paid back on maturity is also fixed (but may be more or less than the amount paid for the bond). However, if the bond is sold before maturity, then more or less than the promised nominal amount may be paid. Whether it is more or less will depend on movements in the level of interest rates after the bond has been issued. If interest rates fall, the market value of an earlier issued fixed rate bond will rise since it offers investors an interest rate higher than that currently being offered on newly issued bonds. The reverse applies if interest rates rise.

An additional risk of bonds is if the issuer of a bond defaults. UK government bonds, known as gilts, are seen as safer than bank and building society accounts, as the government is even less likely than a bank or building society to default. Bonds can be bought through stockbrokers or, in the case of gilts, through a special Purchase and Sale Service organised by the Debt Management Office, the government department responsible for issuing government debt.

One problem with bonds is that not everyone means the same thing when they talk of a ‘bond’. The kinds of bond we have described are company or government bonds with a fixed interest rate and a fixed repayment date. But the term ‘bond’ has sometimes been taken in vain. Financial intermediaries have sold bonds that were in effect shares by another name. Similarly, long-term savings products may not only be bank accounts promising interest, but also linked to company bonds or shares. There is no regulation in the UK on terminology, and consequently it is important to read the small print of any product.

Some National Savings & Investment products use the name ‘bond’ – for example, Premium Bonds and Income Bonds – but are types of deposit. A range of products, some that are deposits and others more risky investments, used to be called Guaranteed Equity Bonds. Although they have since been reclassified as ‘structured products’, they still individually go by names such as Capital Bond, Stockmarket Linked Bond and Double Asset Bond. Therefore, in reality, the term ‘bond’ is applied to products that are very different, and not just company or government bonds. To get round this confusion, you will also see true bonds referred to as ‘fixed interest’ investments – as noted earlier.

An important product that does not fit within the bonds category that we have described is the Premium Bond. Premium Bonds, owned by 22 million investors in the UK in 2016, are a lottery-based form of savings account backed by the UK government. A lottery is held every month and the equivalent of 1.3% p.a. (in 2016) on all the Premium Bonds is paid out in tax-free prizes.