2.3.2 Gilts and the risk-free yield curve

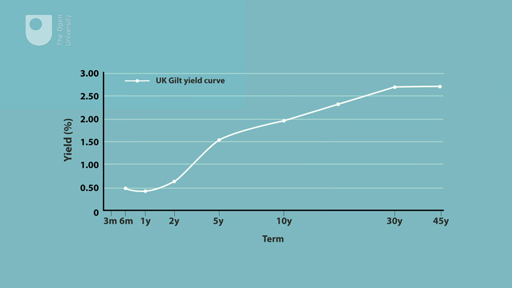

The returns on government bonds (or ‘gilts’) perform a key function in the arena of personal and business finance. The yields provide what is known as the ‘risk-free’ yield curve – the returns you can get for investing in secure (‘default-free’) bonds for different terms to maturity.

Watch and listen to this audio-animation to learn about the ‘risk-free’ yield curve.

In addition to monitoring the Bank Rate and the share prices of certain companies you can also track the yields on two UK government bonds (also known as ‘gilts’).

The two bonds are:-

- Treasury 4.25% 7 December 2027

- Treasury 4.25% 7 December 2046

Both bonds, co-incidentally, have an interest rate (or ‘coupon’) of 4.25% p.a.

The dates shown are the maturity dates of the bonds. The 2027 bond is a ‘medium’ gilt whilst the 2046 bond is a ‘long’ gilt with these terms simply denoting the length of time to their maturity.

You can monitor the price movements and yields of these bonds by setting up a free account withTradeweb [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] . The route to this site can be found on the website of the UK’s Debt Management Office (DMO). When you have done this click on ‘FTSE Closing Prices’ and then scroll down to the two gilts above – labelled ‘UKT 4.25 12/27’ and ‘UKT 4.25 12/46’. The closing yields from the previous trading day are then found across to the right.

Alternatively if you prefer the yields of the gilts can be found in The Financial Times (FT).