3.2.2 Applying portfolio theory

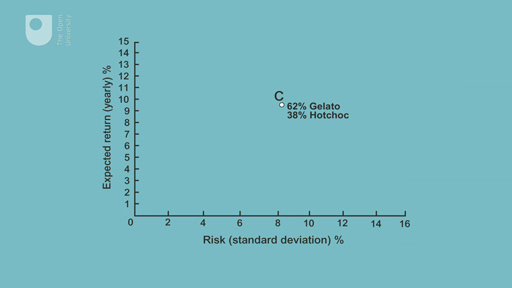

In the previous section, you looked at the risk–return trade-off between Gelato and Hotchoc. However, by combining the two shares in a portfolio, it is possible for the investor to reach a better outcome. Watch this short animation about portfolio theory.

Transcript

The conclusion of the animation is that by reaching the so-called ‘efficient frontier’, the investor is unable to improve their risk-return trade-off. The portfolios on the efficient frontier are said to be Markowitz efficient, named after Harry Markowitz (1959), who was the first person to work out the implications for the mathematics of combining shares into portfolios. By following a strategy to reach the efficient frontier, investors are said to employ Markowitz diversification.

This section concludes the analysis of portfolio theory and the rationale of investment diversification.

Further supporting information the topics below is provided in the document Understanding risk versus return in portfolio theory [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] .