3.4.1 The random walk prediction

The EMH makes the powerful prediction that prices of shares and other financial assets will follow a random walk. The next price movement, up or down, will be unrelated to any of its previous movements. If the hypothesis is correct, there is little scope for investment experts to achieve better returns than others through stock picking and market timing.

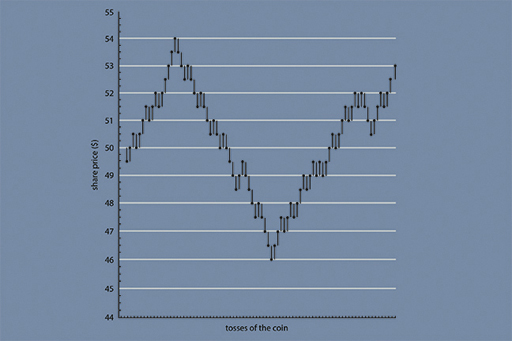

Malkiel (2007) carried out an experiment with his students in which they were asked to toss a coin. The experiment started with a share price of $50. If the coin came out as a head, they were told to add half a point to the share price; a tail would result in a half point cut in the price. Figure 14 is a chart of the stock price for one of these experiments. You can see that it looks like the type of cycle in share prices that we see all the time for companies and stock market indices. Yet this pattern is derived from a purely random event, the tossing of a coin. This argues against the use of technical analysis to look for patterns in stock-market data.

The EMH suggests that there is no reason for such expert investment strategies to work any better than buying stocks in proportion to their weighting in the market index, or even buying a random selection of stocks.

Activity 3.3 The random walk

Which of the following events would you expect to follow a random walk, and why?

- heads or tails when tossing a fair coin

- a football team’s pattern of wins and losses

- sunny or cloudy days during summer.

Answer

Tossing a coin is an example of a random walk – whether it turns up heads or tails next time, is in no way related to the result of the previous toss, or any that went before.

In contrast, a football team’s pattern of wins and losses need not be entirely random, as its chances of success in the next game may be related to its previous result. Several consecutive wins (or losses) may make another more likely, signalling the relative strength (or weakness) of the team, which could be self-sustaining because of soaring (or sagging) morale.

The summer weather is likely to be intermediate: many weather systems are durable enough for one sunny (or cloudy) day to raise the likelihood of another, but they change often enough (at least in the UK) for today’s weather to be a poor predictor of tomorrow’s, which is why weather forecasters remain in strong demand.