4 Recognising value

Customers select the product they think is a superior value (benefits minus price). Competitive advantage is delivering a superior value to enough customers at a low enough cost to generate wealth. So a business is a system for superior value delivery: choosing a superior value proposition, and echoing it through the business system by providing and communicating it.

Everyone knows what is meant by the 'price' of a product. But just as important for strategic purposes is a product’s value to the customer, something that is far less conspicuous because it often depends on the customer’s subjective assessments. A product’s value to customers is, simply, the greatest amount of money they would pay for it. In other words, a product will rarely be purchased when its price exceeds its value to the customer. Conversely, whenever the value of a product exceeds its price, customers can improve their lot by buying it.

The above quotes highlight the widespread sense of value as something that can be measured relative to the price paid by a consumer for a product or service. If the average consumer will pay a higher price for product A than product B, that is thought to be because the average consumer values A more highly than B. But this is not to say that higher-priced items are always those with the higher value.

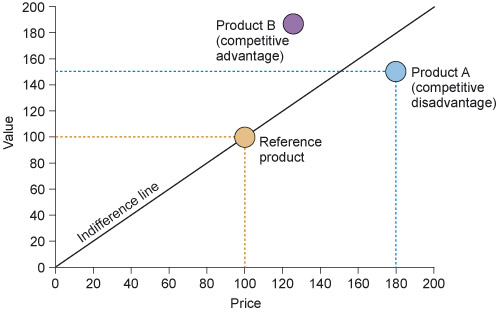

In the price–value model illustrated in Figure 4, the organisation behind Product B is managing to deliver a higher-value product than the producers of product A. Product B has a higher value than Product A, but a lower price. This gives producers of Product B a competitive advantage over the manufacturers of Product A.

The products have been mapped against a reference product (with reference value 100, reference price 100). To gain an advantage over competitor products, manufacturers must aim for products that sit above the line of indifference. Customers offered a product with value 200 and price 200, i.e. a product that sits on the indifference line, are unlikely to switch from buying a reference product (value 200, price 200) with the same value–price ratio.

This model was specifically designed to aid strategic decision-making about which products to release onto a market. But you may like to consider how the thinking behind the model can be applied throughout an organisation, and in situations where there is not an obvious relationship between value and price.

Why am I studying this? The reason for presenting this to you is that when you have identified value (through your commercial awareness), an obvious next step is to review and enhance the value being generated, or the costs and mechanisms by which that value is generated; a process which will require more insight gained through commercial awareness.

Ultimately your actions, wherever you sit in an organisation, will have a bearing on how end users value the organisation’s outputs. A fraction of the value of an end product or service is (at least in principle) attributable to you. But to recognise the value you’ve added doesn’t always require you to analyse the final product offered by your organisation. The interim products or services that you deliver to internal customers, and those that are delivered to you by internal suppliers, might also be considered in terms of value–price or in terms of cost–value ratios, which will help deliver services in a more cost-effective way.

Within this course and its treatment of value, where we have focused on prices (and costs), the discussion has assumed an intimate link between value and money; it has assumed the recipients of the outputs of organisations always want ‘value for money’. However it is important to note – although this theme will not be developed – that there are alternative assessments of value. The following extract gives a flavour of such an alternative and its importance in commercial environments.

companies are more than instruments for generating money; they are also vehicles for accomplishing societal purposes and for providing meaningful livelihoods for those who work in them. According to this school of thought, the value that a company creates should be measured not just in terms of short-term profits or paychecks, but also in terms of how it sustains the conditions that allow it to flourish over time.

These sorts of values may be difficult to measure and quantify – they may even run counter to certain political or corporate agendas – but they are values none the less, and what is presented in this course is applicable to these too.