2 Understanding income tax

Employees

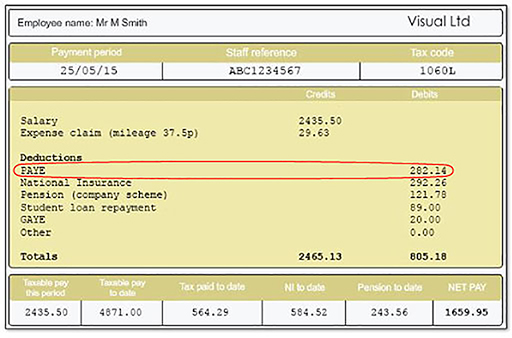

When you earn money by working for an employer you don’t normally receive the whole of your wage (your ‘gross’ income). Instead, you get your gross income minus certain payments such as tax and National Insurance. What’s left is your ‘net’ income – and this is the amount you actually receive.

Self-employed

If you are self-employed your earnings are not automatically taxed. Payments for the work you undertake are made without tax deductions. So the onus is on you to set aside the money that you will have to pay after you have made your annual tax return.

One way to help ensure you retain the money that is due to be paid in tax is to open a new bank account and place into it one-third of all the money you receive for your work. Having this separate account will help ensure that you do not spend the money before you have to pay it to the taxman. Setting aside one-third of your earnings is not a precise estimate of your tax bill but it is a good enough approximation that will avoid you getting into a panic when the tax is due.

If you employ an accountant then they will help you with your tax planning.

Deductions from your gross earnings

In the UK the top two payments that come out of your gross income are income tax and National Insurance Contributions (NICs), which are covered in the next section. Other deductions may be made too, like contributions to a pension scheme – but here you’ll focus on what for most people are these main two payments.

Income tax is imposed – levied – on almost all types of income including pensions (but it’s not payable on gifts, lottery winnings, Premium Bond winnings and ISA earnings). When it’s collected by HMRC through an employer (when the worker is employed rather than self-employed) it’s often referred to as a ‘pay as you earn’ (PAYE) tax.

Income tax is paid on income that is received by you within a given tax year (6 April in one year to 5 April of the following year).

You are allowed to earn up to a certain amount of money before having to pay income tax. This is called receiving the ‘personal allowance’, which is £12,570 for the 2024/25 tax year.

The allowance is higher for certain groups of people, such as those who are registered blind. The plan had been for this personal allowance to increase each year in line with the rate of price inflation measured by the Consumer Price Index (CPI). The impact of the Covid-19 pandemic on government finances meant tax thresholds were frozen in place, and this freeze has since been extended.

The personal allowance has an income limit of £100,000. If you earn above this limit the allowance tapers away, and those earning more than £125,140 a year (in 2024/25) don’t get any personal allowance.

Income tax in England, Wales and Northern Ireland

If you earn more than your personal allowance in any tax year, you will need to pay on the amount you earn above it. In England, Wales and Northern Ireland, there are three different tax bands in 2024/25:

- the first £37,700 above the personal allowance was taxed at 20%, known as basic-rate tax

- between £50,270 and £125,140 of taxable income, the rate is 40%, known as higher-rate tax

- there is a rate of 45% on taxable incomes over £125,140, known as additional-rate tax.

Wales and Northern Ireland currently have the same income tax rates and bands as England. Partial powers to set income tax have been devolved to Wales although, to date, the effective tax bands and rates have remained the same as those in England.

Income tax in Scotland

Since 1999 Scotland has had some discretion in respect of taxes and now has an increasingly different income tax structure. In 2024/25:

- the first £2,306 above the personal allowance is taxed at 19%

- the next £11,685 is taxed at 20%

- the next £17,101 is taxed at 21%

- the next £31,338 is taxed at 42%

- from £62,710 to £125,140 of taxable income, a 45% tax rate applies

- there is a rate of 48% on taxable incomes over £125,140.

The economic impact of income tax

Income tax is the largest source of tax revenue – contributing nearly a third of the government’s tax receipts. This income is then used to pay for government spending, on things like the police, the NHS and the civil service.

Income tax is a form of progressive tax. This means that the proportion of income paid in income tax rises as earnings rise. For example in 2024/25 someone in England, Wales or Northern Ireland earning £25,000 would pay 9.9% of their earnings in income tax. Someone earning £100,000 would pay 27.4% of their earnings in income tax.

In setting income tax rates, the government does need to take into account the impact on the incentive to work. High rates of income tax can deter people from taking on extra work or seeking jobs with greater responsibilities paying higher incomes. People making such decisions will often focus on what extra net income they get – the money in their pocket each month. High tax rates mean they’ll only see small increases and this may mean they’re less likely to do the additional work.

At the end of this session, you will find a link to MoneySavingExpert’s income tax calculator to help you check if you are paying the right amount of tax.