3.2 Is productivity sustainable?

Are the recent increases in productivity sustainable? The answer to this question, and the crux of the debate concerning the effect of IT, centres on distinguishing whether recent increases in productivity are just cyclical, and hence temporary, or whether they are the beginning of a new and long-lasting trend. If the increase in productivity in the USA in the late 1990s was cyclical, this means that it occurred simply because the US economy as a whole was undergoing a boom in the latter half of the 1990s, and the increases will disappear now that (as I write) the boom is over. All economies fluctuate in a business cycle. For a few years, growth is quite rapid, output and incomes rise, and unemployment falls. This is the ‘boom’. Then the cycle turns. Growth slows, and in a true recession the total output of the economy falls. This is the down-turn of the cycle. The cycle is driven by changes in consumer spending and business investment and, historically, a boom or recession tends to last three to eight years.

However, if the productivity increases of the late 1990s, especially in the USA, were a trend increase, this means that the rise in productivity was independent of the business cycle and resulted from the characteristics of new technologies or specific government policies. For example, if a new technology allowed the productivity of many industries to increase permanently, it would create a trend increase in productivity. If the rise in productivity persisted during a recession, it would be further evidence of a trend. Indeed, the word ‘new’ in the ‘new economy’ implies that the increase was a trend related to the characteristics of the new technologies (otherwise it would not be new).

IT can affect productivity by increasing the efficiency of the IT-producing sectors, such as computer manufacturers, and/or by increasing the productivity of the IT-using sectors, such as the service industries that process data using computers. There is really no debate at all on the former point: all agree that industries such as the computer and software industries have experienced great productivity increases due to the radical and rapid nature of technological change in these industries. In the 1990s the average productivity growth in the IT-producing sectors was 24 per cent per year, well above that of the other manufacturing sectors. The disagreement, therefore, is about the effect of IT on the rest of the economy.

The optimists in this debate, including Alan Greenspan, Chairman of the US Federal Reserve Bank (1987–2006), argue that the rise of IT has allowed most advanced capitalist economies to achieve a permanent (trend) higher level of productivity, because of the ways in which the new technologies have improved efficiency, for example through better control of inventories and cheaper access to information. They argue that IT has caused firms to increase their investment in capital equipment per worker and that this has occurred simultaneously with large increases in the productivity of other inputs, both machinery and labour, two-fifths of which has come from efficiency gains in computer production alone. These optimists argue that productivity increases will persist into the future, due to the rise in research and development spending and the rise in investments in business capital, including computers. Such investments, argue the optimists, should allow productivity to keep growing.

Pessimists, such as the US economist R.J. Gordon, claim that recent productivity gains have been only cyclical, that is, a result of the fact that the US economy has been experiencing a boom. A boom can cause productivity to increase because there is more work to be done during prosperous periods and hence there is a greater incentive for employers to work employees harder, making them more productive – and leading to an increase in productivity. To support his point, Gordon (2000) provides data showing that most of the productivity gains have been limited to the IT-producing sectors (such as the personal computer industry) and have not spread out to other sectors, including the IT-using sectors. In fact, after excluding the manufacture of durable goods and computers (12 per cent of the economy), and after adjusting for the business cycle, the statistics do not show any productivity increases in the remaining portions of the economy! And to make things even worse, it is in those sectors where IT has been used the most, such as financial services, that productivity increases show up the least.

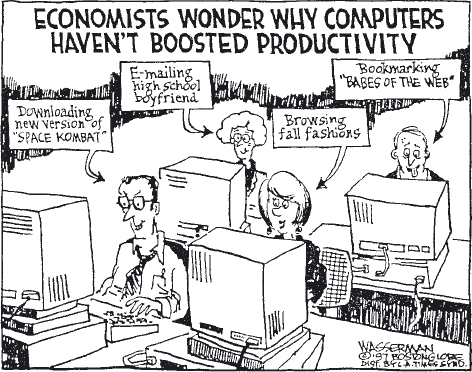

Gordon (2000) claims that it is not so surprising that the rise of the internet has not affected productivity to the same degree as the development of electricity did. Unlike electricity, the internet has not produced new products; it has simply substituted for existing products (e.g. the substitution of online purchasing for mail-order catalogues). Likewise, most of the changes are in terms of market shares not productivity: what one company wins the other loses, as is evidenced by the effect that Amazon.com is having on the profitability of the big bookshop chains Borders and Waterstones. Electricity, however, made possible the invention of many new products such as the vacuum cleaner and the refrigerator. The electric motor, the aeroplane, the telephone and even the indoor flush toilet, invented by the Englishman Thomas Crapper in 1886, have had more effect on productivity than the internet. Surfing the internet may be fun and is often useful, but can its impact on production be compared to the effect of electricity on the illumination of factories and the rise of the assembly line? Some go as far as to say that, if anything, the internet has reduced productivity by distracting people from serious work, a claim that is behind the popular joke that IT stands for ‘insignificant toys’ (Figure 1). Gordon (2000) quotes the finding by Active Research Inc., a San Francisco internet-based market research company, that online shopping does not peak in the evening when workers are at home, but in the middle of the day when they are in the office!

Other sceptics point to the possibility that the rise in US productivity has been due more to the increased flexibility of the US labour market than to any specific characteristics of information technology. OECD studies comparing the US experience with that of other developed countries have found that the high US productivity growth in the mid 1990s was followed only in Australia, Finland and Canada, and not at all in Germany, Italy, France and Japan, which have less ‘flexible’ labour markets (Colecchia and Schreyer, 2002). Flexible labour markets are defined as those in which there are fewer government (and trade union) regulations concerning working conditions and pay scales and in which industrial trade unions are weaker or non-existent. For example, it is well known that in the USA workers can be fired much more easily (often indiscriminately) than in European countries. Hence, a lesson that may be drawn from the OECD reports, although it is not stated directly, is that the higher productivity of the ‘flexible’ countries might be due, not to IT, but to the fact that workers in those countries can be worked harder, paid less and fired more easily.

However, Gordon's (2000) findings have been criticised in turn for not taking into account the difficulty of measuring productivity in an economy characterised by rapid technological change. The issue here is that the traditional measurements of output used to calculate productivity figures do not take into consideration changes in the quality of output, such as improved product quality, choice, time savings and convenience. This is a big problem for productivity calculations as it means that if more change occurs on the quality side than on the quantity side, that is, better products rather than more products, the total change in output will be severely underestimated.

This problem is even greater in the service sector as most service improvements come in terms of not more services but better services. For example, output in the health-care industry will be underestimated if all that is counted is patient throughput or treatment episodes, without accounting for the extent to which consumers enjoy better treatment. Quality improvements in health care include better diagnosis, new medical equipment and less invasive treatments. Another example is provided in a study cited by The Economist (2000). This study claimed that when changes in the quality of output are not recognised, output in the US banking industry appears to have grown by only 1.3 per cent between 1977 and 1994. If quality changes are included, for example by taking into account the rise of automated teller machines and online banking, the study argued that output appears to have grown by 7 per cent!

Another way in which consumer satisfaction is not recognised in traditional productivity accounts is by neglecting the wider choice that people have in the products they buy. In the extreme case, if the same amount of output is produced in one year as in the previous year, but the choice of products has doubled, the official measures would not pick that up as a change in output. These are not problems in a world of mass production, where the point is to produce a lot of standard goods for the general consumer, but they are problems in the world of mass customisation, where the point is to produce the ‘right’ goods for the specific consumer. Nonetheless, economists have devised methods to tackle these problems, some of which will be discussed in Section 4.