4.2.2 Interest rates – fixed or variable?

Activity _unit4.3.1 Activity 2

Under what circumstances do you think it might be attractive to borrow at (a) a fixed rate of interest and (b) a variable rate of interest?

Discussion

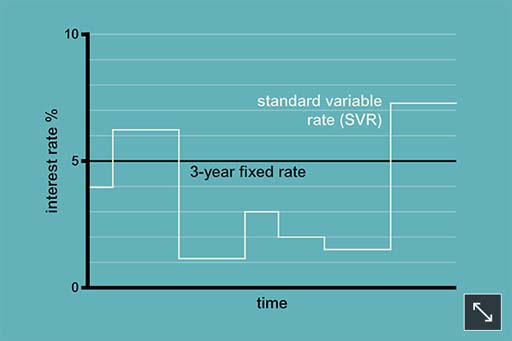

Assuming that borrowers have a choice and want to pay as little interest as possible, choosing a fixed rate may be preferred if rates are expected to rise, and a variable rate may be preferred if interest rates are expected to fall.

However, to assess which would be cheaper requires a forecast of how rates will move during the life of the loan, and making such forecasts is difficult because it is difficult to predict future rates of inflation and interest rates. In addition, the choice may reflect the borrower’s household budget. For example, households on a tight budget may choose a fixed rate because this would provide certainty of monthly expenditure.

What about your own debts – have you borrowed at a fixed or variable rate of interest?