6.2.3 Remortgaging

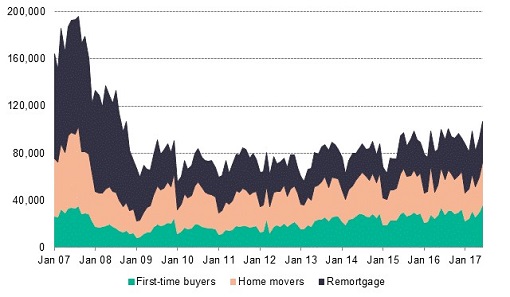

Increased competition in the mortgage market has increased the popularity of ‘remortgaging’. This involves repaying an existing mortgage and taking out a new mortgage at a lower rate, from either an existing or a new lender.

Remortgaging may come about after a regular review of household finances or could be triggered by changes in household income, by changes in interest rates or by the end of being locked into a particular mortgage contract.

Remortgaging might seem simple, but there are costs. In addition to legal costs, there may be ‘early redemption’ or ‘prepayment’ fees. Generally these fees last for the first few years of the mortgage, or the period of any special deals, but sometimes they extend beyond a special deal (called a tie-in).

The terms of early redemption fees will be included in the KFI. When repaying a longer term, fixed-rate mortgage early, the prepayment fees may be substantial – a fee of six months’ interest is not uncommon.

This does not necessarily mean that remortgaging might not save money, particularly if interest rates have fallen a long way since the initial mortgage was arranged. It simply means that households need to make careful comparisons.

Any savings made from remortgaging will help with the budgeting process you explored earlier in the course. Stop and think about this next.