3.4 Income and expense accounts

A successful business will have many transactions and, rather than take the profit or loss to owner’s capital on each transaction, similar income or expenses are collected together in separate accounts in the nominal ledger. These accounts are totalled at the end of a time period (at least once a year but probably each month as well) to measure the total profit or loss for that period. The P&L account, when published as a financial statement, is a summary of all the income and expense accounts that reflect the year’s trading transactions.

As with assets and liability items, items of income and expense are recorded in nominal ledger accounts according to set rules. Expenses are always recorded as debit entries in expense accounts and income items are always recorded as credit entries in income accounts.

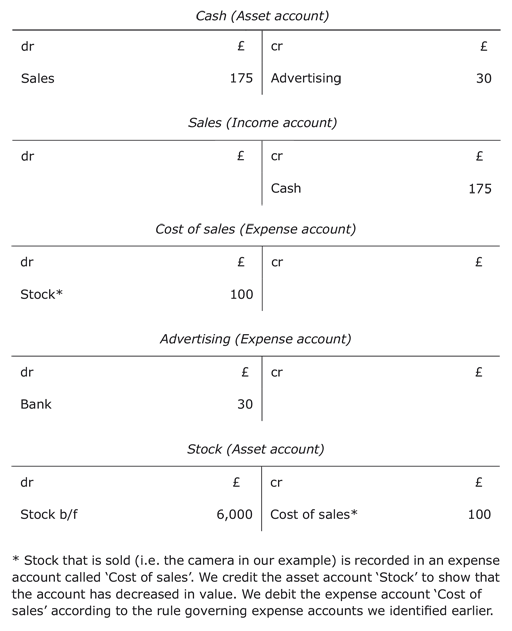

We will now look at Peter’s Photographic Enterprises’ initial transactions as they would be dealt with in the nominal ledger.

We could prepare a P&L account from those T-accounts that we indicated were either income accounts or expense accounts.

| £ | ||

|---|---|---|

| Sales (Income account) | 175 | |

| Cost of sales (Expense account) | Total 100 | |

| Gross profit | 75 | |

| Expenses | ||

| Advertising (Expense account) | Total 30 | |

| Net profit for the period | Total 45 | |

| The effect on the balance sheet would be: | ||

| Assets | ||

| Increase in cash | +£145 (the increase in the cash T-account) | |

| Decrease in stock | –£100 (the decrease in the stock T-account) | |

| Liabilities | ||

| No change | ||

| Change in net assets | +£45 | |

| Capital | ||

| Profit | +£45 |

Information point

In the example above the net profit of £45 is not the same as the increase in cash of £145. As we learned in Section 3.1, net profit is often very different from the increase or decrease in cash in the same period.

Activity 19

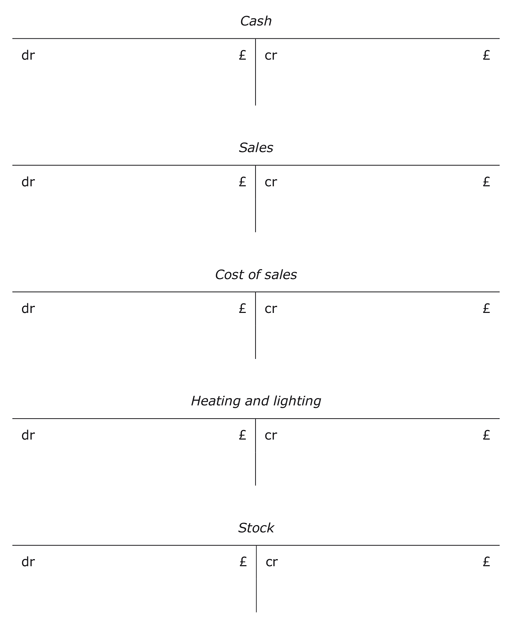

A business carries out the following cash transactions:

- a.business buys stock of bicycles for £1,000

- b.customer pays £300 for one bicycle (cost of bicycle is £200)

- c.business pays £45 for electricity.

Enter these on the T-accounts below, and draw up a P&L account.

Answer

| £ | |

|---|---|

| Sales | 300 |

| Cost of sales | Total 200 |

| Gross profit | 100 |

| Expenses | Total 45 |

| Net profit | Total 55 |