3.6 The accounting equation and the double-entry rules for income and expenses

As we saw in Section 3.2, the accounting equation, extended to include income and expenses, can be expressed as follows:

A – L= C+ (I – E)

This equation can be rearranged as A+ E =C+ L+ I according to the rules of mathematics.

The next activity should help you to understand the importance of both forms of the accounting equation.

Activity 21

A business has assets of £110,000, liabilities of £30,000, income in the year of £20,000 against expenses incurred of £10,000 and capital at the beginning of the year of £70,000. Using the two forms of the accounting equation, insert these figures into each equation to show that the equation holds true in both cases.

Answer

Each form of the equation is correct as both sides of the equal sign in each case would have the same figure.

In the first form of the accounting equation, A – L= C+ (I – E), the answer would be:

£80,000 (£110,000 – £30,000) = £80,000 (£70,000 + (£20,000 – £10,000))

In the second form, A+ E =C+ L + I, it would be:

£120,000 (£110,000 + £10,000) = £120,000 (£70,000 + £30,000 + £20,000)

What is the point of knowing the second form of the accounting equation?

This second form of the equation, i.e. A + E =C + L + I, is very useful to remember as it gives you all the rules of double-entry bookkeeping, including the ones for income and expense accounts.

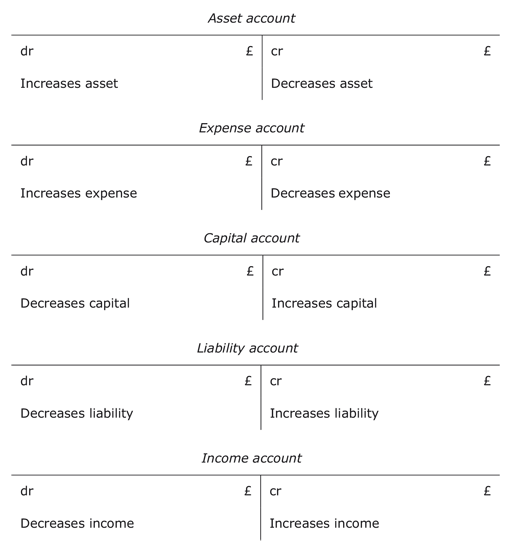

Assets (A) and expenses (E) are on the left side of the equation representing debit balances. The double-entry rule is thus: if a transaction increases an asset or expense account, then the value of this increase must be recorded on the debit or left side of these accounts.

Likewise in the equation, capital (C), liabilities (L) and income (I) are on the right side of the equation representing credit balances. The double-entry rule is thus: if a transaction increases a capital, liability or income account, then the value of this increase must be recorded on the credit or right side of these accounts.

The following T-accounts may help you to learn these ‘golden rules’ of double-entry bookkeeping.

In the final activity of this section, you will need to apply your knowledge of the double-entry rules, the P&L account, the balance sheet and the accounting equation.

Activity 22

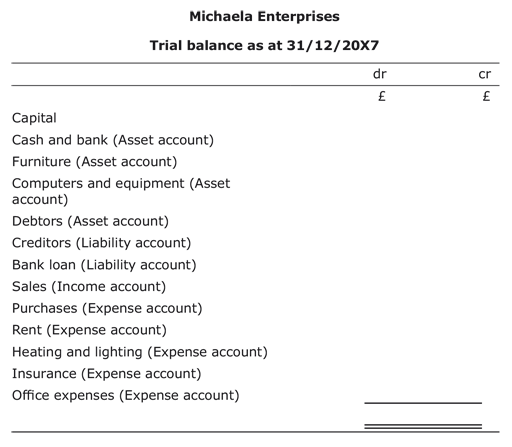

Jane Michaela, trading as Michaela Enterprises, has the following closing balances in ledger accounts for her first year in business, the financial year just ended on 31 December 20X7:

- Opening capital £5,000

- Cash and bank £2,853

- Furniture £3,200

- Computers and equipment £2,010

- Debtors £790

- Creditors £1,100

- Bank loan £2,000

- Sales £33,230

- Purchases £21,565

- Rent £6,053

- Heating and lighting £1,256

- Insurance £988

- Office expenses £2,615

- Using the template below, complete the trial balance for the year.

- Using the formula I – E (Income – Expenses), calculate the net profit for the year ended 31/12/20X7 if the closing stock was £200.

- Using the formula C+ (I – E) (Capital + (Income – Expenses)), calculate the capital as at 31/12/20X7.

- Using the formula A – L (Assets – Liabilities), calculate the net assets as at 31/12/20X7.

- What do you notice about your answers to 3 and 4?

Answer

- £33,230 – (£21,565 – £200 closing stock) + £6,053 + £1,256 + £988 + £2,615 = £33,230 – £32,277 = £953 net profit for the year ended 31/12/20X7.

- £5,000 + £953 net profit = £5,953 capital as at 31/12/20X7.

- (£2,853 + £3,200 + £2,010 + £790 + £200 closing stock not included in trial balance) – (£1,100 + £2,000) = £9,053 – £3,100 = £5,953 net assets as at 31/12/20X7.

- The answers to 3 and 4 are exactly the same. This again demonstrates that the accounting equation in the form A – L = C + (I – E) is always true.

Information point

Closing stock is not included in the trial balance as it does not reflect a transaction that has a dual aspect – it is merely the purchases that have not been sold in the year. If there is any opening stock it is included in the trial balance at the year end.