This content is associated with The Open University's Economics courses and qualifications.

What is the impact of climate risk on financial sector stability? Will countries facing the greatest climate risks also face the steepest rise in cost of public borrowing?

Trailer

Watch the trailer below for an OU Economics seminar on climate change:

.

Learning outcomes

After exploring the seminar material, you will be able to discuss challenges of mobilising finance for a sustainable transition. You will learn about the dangers of a vicious circle between climate vulnerabilities, cost of capital and rising fiscal vulnerabilities.

Climate change, sovereign risk and the cost of capital

Ulrich Volz, Professor in Economics at SOAS (School of Oriental and African Studies), explained that there is a danger that vulnerable developing countries will enter a vicious circle in which greater climate vulnerability will raise the cost of debt and diminish the fiscal space for investment in climate resilience.

He explores the link between climate change and sovereign risk and assesses the effects that climate risks have on the cost of government debt. Enhancing economic resilience and climate-proofing public finances is needed to address the looming debt crisis in the global south. One of the ways proposed to deal with these problems is debt relief targeted for green and inclusive recovery that will empower governments to invest in climate resilience and other strategic areas of sustainable development.

Governments must climate-proof their economies and public finances, or they will potentially face an ever-worsening spiral of climate vulnerability and unsustainable debt burdens.

Ulrich Volz is a Professor in Economics at SOAS University of London and Founding Director of the SOAS Centre for Sustainable Finance. He is also a Senior Research Fellow at the German Development Institute and Honorary Professor of Economics at the University of Leipzig. At SOAS, he previously served as Head of the Department of Economics and Member of the University’s Executive Board. Ulrich is Chairman of the Japan Economy Network and Co-editor-in-chief of the Asia Europe Journal. Ulrich holds a PhD from Freie Universität Berlin and was a Fox International Fellow and Max Kade Scholar at Yale University. Ulrich was part of the UN Inquiry into the Design of a Sustainable Financial System and has acted as an advisor to several governments, central banks, international organisations and development agencies on matters of sustainable finance and development.

In the video below, Ulrich explores the links between sovereign risk, biodiversity risk and climate change, developing his proposal for a green and inclusive recovery.

.

What should inclusive and green recovery policies look like?

Elva Bova is Deputy Head of the National Fiscal Frameworks and Institutions Unit in the European Commission’s Directorate General for Economic and Financial Affairs (DG ECFIN). From 2010 to 2016, she was an Economist at the International Monetary Fund (IMF) in the Fiscal Affairs Department. She also worked as the Senior Economist of the Foundation for European Progressive Studies. Prior to joining the IMF, she obtained her PhD from the School of Oriental and African Studies, University of London. She has published on public finance, inequality and labour market.

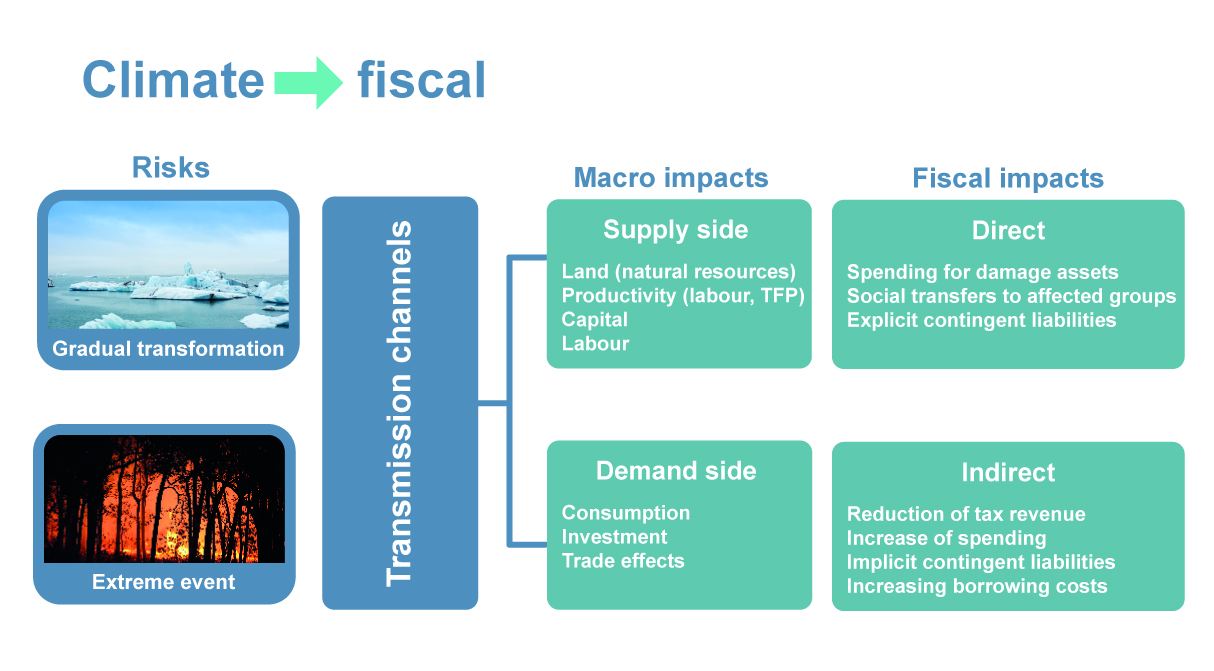

In the video below, Elva explores the direct and indirect fiscal impacts that climate change may have. A number of policy priorities are discussed:

- Integrating climate risks into debt sustainability analysis.

- Greening fiscal budgets: how can fiscal policies help achieve environmental goals?

- EU Green Bonds: voluntary standards for bond financing.

.

About us

OU Economics is about real-world economics: through a pluralist approach to the subject, we teach the analytical techniques and practical skills required to understand the world of production, employment, spending and borrowing, and the effects of government policy and technical innovation. Our economics degree programmes and modules are regularly updated to reflect the latest research and events.

The OU Economics Seminar Series promotes high-quality research bringing together academics to exchange, share and engage in dialogue with policymakers, practitioners, industry representatives and members of the public. With an ethos of inclusivity and respect for diverse realms of economic expertise, the seminar series will bring together those working on current challenges across a broad range of research interests: Social Policy, Personal Finance, Innovation, Macroeconomics, Development Economics, Health, Inequality and Employment, Philosophy and History of Economics.

Rate and Review

Rate this video

Review this video

Log into OpenLearn to leave reviews and join in the conversation.

Video reviews