5.2 Becker's ‘employer taste’ model

The most prominent neoclassical explanation of discrimination is based on the work of Gary Becker and develops the idea that some workers, employers or customers do not want to work with or come into contact with members of other racial groups or with women (Becker, 1971). No explanation is given as to why this prejudice exists, rather it is simply assumed that there is a ‘taste’ or preference against people from disadvantaged groups and that this taste can be treated in exactly the same way that economists would analyse individual preferences between goods and services.

Suppose that an employer does not want to employ members of a particular group even though these workers are as productive as any others. If the firm has to pay all workers the same wage it will simply not employ members of the disadvantaged group. However, if it is possible to pay these workers less than those from other groups the firm then faces a trade-off: it can employ members of the disadvantaged group at lower wages and thus increase its profitability, or it can discriminate and employ only workers from the high wage group even though this will mean lower profits. Discrimination in the latter case therefore imposes a cost on the firm.

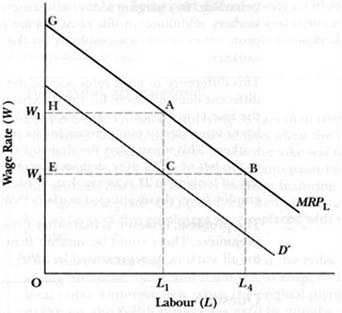

Figure 2 can be used to show what happens in these circumstances. Let us assume for the sake of simplicity that there are no differences in productivity between different groups of workers. Since all workers have the same level of productivity, the marginal revenue product (MRP) curve faced by the firm is the same, irrespective of which workers they employ. This is shown as MRPL, the demand for labour curve. In a competitive labour market, a firm will employ labour up to the point where the wage equals the marginal revenue product of labour (which is why the MRPL curve is also the firm's demand curve for labour). So, if the wage rate is W1 the firm will employ L1 workers. If the firm discriminates against members of a particular group, no workers from this group will be employed at W1. This employer will simply exercise prejudice against them and, if this is a common practice amongst firms, the disadvantaged group will face unemployment.

What would happen if these workers were prepared to work at wages below W1? Clearly, this will depend upon the extent to which the firm is prepared to discriminate since by employing disadvantaged workers at lower wages, the firm can lower its costs and thus increase its profits. Suppose that the firm is prepared to pay to L1 workers from the disadvantaged group.

Activity 2

Use Figure 2 to identify the volume of total profits which the firm would make from this discrimination.

Answer

The following text will help increase your understanding about how this volume was generated.

For each unit of labour employed, the firm makes profits equal to the difference between revenue (MRPL) and cost (W4). At L1 units of labour employed, total profits consist of the sum of differences between MRPL and W4 for each unit of labour employed between O and L1. These total profits are represented by the area AGEC.

Now, if the firm only employed workers towards whom it is not prejudiced at a wage W1, then total profits would be represented by AGH. Figure 2 shows that the firm gains additional profits from its discriminatory behaviour. By charging a discriminating wage of W4 to disadvantaged workers, additional profits of ACEH are made by the firm. These additional profits compensate the employer for the prejudice held for disadvantaged workers.

This difference in wage rates paid to the two groups of workers results in a different demand curve for the disadvantaged group. This is represented by the line D' in Figure 2. For each level of employment the firm pays a lower wage rate to compensate for its prejudice against disadvantaged workers. This means that the demand curve for these workers is parallel but to the left of MRPL (the demand curve for advantaged workers). Another way of looking at D' is to say that, at each wage rate, the firm is prepared to employ fewer disadvantaged workers than it will advantaged workers.

The problem, however, is that other firms may not hold the same prejudices. There could be another firm which has only one demand curve for all workers, as represented by MRPL.

Activity 3

Assume that a non-prejudiced employer hires labour at a wage rate of W4. Using Figure 2, identify the following:

the total profits made by this firm;

any additional profits made in comparison to the prejudiced firm.

Answer

The non-prejudiced employer, paying a wage rate of W4, would employ L4 workers regardless of their colour or creed. It would make total profits of BGE. By not being prejudiced this firm gains additional profits of BCA in comparison to the profits of AGEC made by the prejudiced firm. The problem, therefore, is that it is difficult for any one firm to indulge in prejudices without losing out to more profit-hungry non-discriminatory firms. Moreover, the additional amount of labour employed by these other firms would enable them to produce more output, thereby forcing down the prices of goods sold in the product market. This fall in product prices would drive the discriminatory firm out of business.

Although we have only considered a simple variant of the Becker approach to labour market discrimination, it is sufficient to highlight the most important conclusion. This is that discrimination can persist only if there are factors which limit the amount of competition in the labour market or in the product market. If these markets are competitive, the increased profitability of non-discriminating firms compared to discriminating ones will encourage non-discriminators to enter the market. This will put downward pressure on the price level and eventually force the higher-cost discriminating firms out of business. The extent of the inefficiency faced by discriminating firms is shown by the fact that, at wage W4 discriminating firms employ L1 workers, whereas a non-discriminating firm would employ L4 workers and produce more output as a result. If, however, there are substantial barriers to entry which make it difficult for new firms to enter the market, competition will not erode discrimination.

The ‘employer taste’ model predicts that discrimination exists because employers do not want to employ certain groups of workers and will only do so if these workers are paid lower wages than those paid to workers in general. It thus provides an explanation of wage discrimination – equally productive workers being paid different wages. Other variations on this theme involve discrimination by workers and customers. The case study that follows provides an example of perceived customer discrimination by the Ford Motor Company.

Think global, act prejudiced?

Ford is better known for spraying its cars than re-spraying its employees. Indeed, in the bad old days when the company seemed to specialise in producing tinny boxes, the joke was that Ford's profits came from its skill in spraying metal onto paint rather than the other way around. But when an advertisement featuring line workers from its Dagenham plant in England was used in Poland, the black and brown faces of five employees were replaced with white faces (and hands).

The reason, according to Ford, was that the Poles are not used to seeing non-white faces, and it wanted to adapt its advertisement to suit local tastes. Unfortunately, when the original picture was reused back in Britain, the Polish version was used by mistake.

When they noticed what had happened, the line workers at Dagenham all walked out for three hours – a rare event in a British factory nowadays. Ford, which has apologised to the victims of the retouching and sent them a cheque for £1,500 ($2,320), blamed a mistake by its advertising agency, Ogilvy & Mather. The agency cannot say who was responsible for the mistake, because it happened 18 months ago, and institutional memories in creative organisations clearly do not stretch back that far.

In some ways the Ford saga, which immediately provoked cheap jibes along the lines of ‘Any colour you want as long as it's not black’, unveils yet another problem of globalisation. In America and Europe, Ford is abolishing many of its regional fiefs and setting up transnational product groups. On the other hand, it has told its managers to demonstrate sensitivity to local peculiarities – particularly on the marketing side. Nobody at Ford seems to be apologising for what happened in Poland.

Source: Economist, February 1996