3 Competitive markets and market failure

You have considered some reasons why firms build on flood plains and households buy homes there. Economic theory provides a way of formalising this type of analysis and, where these behaviours are seen as problematic, offers insights into possible solutions.

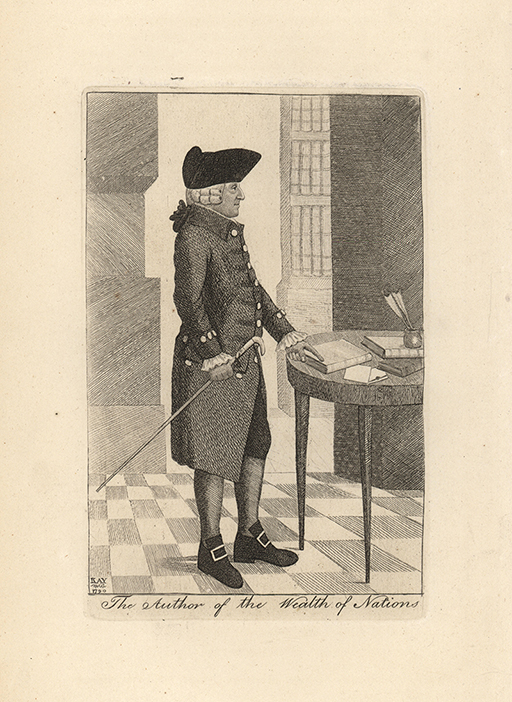

While there are competing theories of economics, a dominant approach among policymakers is a belief that freely operating markets are the most efficient way of allocating resources in an economy. This approach is captured in a famous quote from Adam Smith (1723-1790), a Scottish philosopher often called the ‘father of economics’:

‘It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.’

Smith was saying that markets in which buyers and sellers are free to buy and sell the amount they wish of a good, at the best price they can find, will result in prices and quantities traded that represent not just the optimal (best) outcome for private buyers and sellers, but for society as a whole. This underpins the neoliberal perspective of capitalism that has been prevalent since the 1980s.

For the pursuit of individual goals to also deliver the best outcome for society depends on markets operating in a state of perfect competition. If they don’t, this is described as a market failure. This section briefly explains how economically efficient markets work and models two reasons why there may be market failures in the market for houses on flood plains.