2.6 Balancing off accounts and preparing a trial balance

What is a trial balance?

A trial balance is a list of all the balances in the nominal ledger accounts. It serves as a check to ensure that for every transaction, a debit recorded in one ledger account has been matched with a credit in another. If the double entry has been carried out, the total of the debit balances should always equal the total of the credit balances. Furthermore, a trial balance forms the basis for the preparation of the main financial statements, the balance sheet and the profit and loss account.

How do we prepare a trial balance?

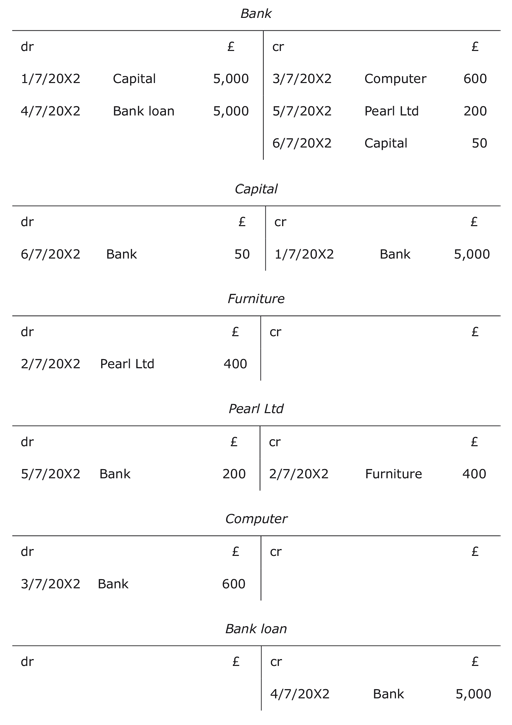

In order to prepare a trial balance, we first need to complete or ‘balance off ’ the ledger accounts. Then we produce the trial balance by listing each closing balance from the ledger accounts as either a debit or a credit balance. Below are the T-accounts in Edgar Edwards’ nominal ledger. We need to work out the balance on each of these accounts in order to compile the trial balance.

What is the procedure for balancing off accounts?

Accounts are straightforward to balance off if they consist of only one type of entry, i.e. only debit entries or only credit entries. In this case, all the account entries are simply added up to get the balance on the account. If, for instance, a bank account has three debit entries of £50 each, then the balance on the account is a debit balance of £150. However, when accounts consist of both debit and credit entries, the following procedure should be used to balance off these accounts:

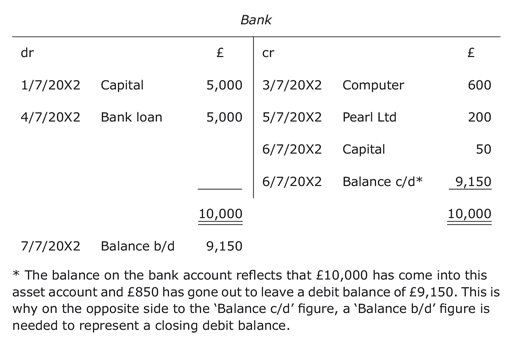

- Add up the amounts on each side of the account to find the totals.

- Enter the larger figure as the total for both the debit and credit sides.

- For the side that does not add up to this total, calculate the figure that makes it add up by deducting the smaller from the larger amount. Enter this figure so that the total adds up, and call it the balance carried down. This is usually abbreviated as Balance c/d.

- Enter the balance brought down (abbreviated as Balance b/d) on the opposite side below the total figure. (The balance brought down is usually dated one day later than the balance carried down as one period has closed and another one has started.)

Using the rules above we can now balance off all of Edgar Edwards’ nominal ledger accounts starting with the bank account.

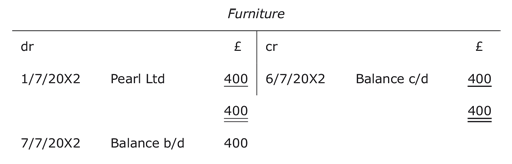

We balance off the capital account in the same way as we did the bank account.

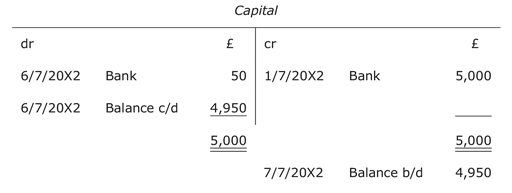

The furniture account has a single entry on one side. This amount is the total as well as the balance in the account.

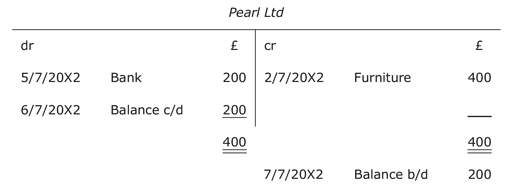

The account for the creditor, Pearl Ltd, has a debit and a credit entry so we will use the method we used for the bank and the capital accounts.

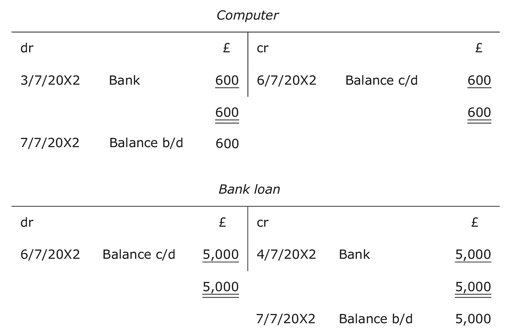

The computer and bank loan accounts have single entries on one side, like the furniture account, so they need to be treated in the same way.

Making a list of the above balances brought down produces a trial balance as follows.

| dr | cr | |

|---|---|---|

| £ | £ | |

| Bank | 9,150 | |

| Capital | 4,950 | |

| Furniture | 400 | |

| Pearl Ltd (a creditor) | 200 | |

| Computer | 600 | |

| Bank loan | 5,000 | |

| Total | Total 10,150 | Total 10,150 |

Information point

From the trial balance we can see that the total of debit balances equals the total of credit balances. This demonstrates for every transaction we have followed the basic principle of double-entry bookkeeping – ‘ for every debit there is a credit ’.