5 Comparing sole trader and company financial statement formats

The balance sheet is the fundamental financial statement because it expresses the balance sheet equation (Assets = Capital + Liabilities or Assets – Liabilities = Capital) which underlies double-entry bookkeeping and financial accounting. The balance sheet summarises the balances in the general ledger accounts related to assets (the resources of the business), liabilities (the debts and other obligations of the business) and capital (the owners’ equity) at a date. The balance sheet shows the financial position of the business at a point in time.

The income statement summarises the changes in assets and liabilities (recorded as the flow of income and expenses during a period of time) that generated the profit or loss for the period. The income statement shows the financial performance of the business over a period of time.

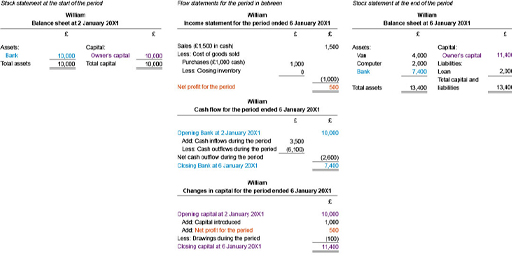

Flow statements for a period link the balance sheet at the start of the period to the balance sheet at the end of the period. The income statement is a flow statement because it shows how income and expenses caused the increase or decrease in capital from one period to the next. The cash flow statement is a flow statement because it shows the increase or decrease in cash from one period to the next. The statement of changes in equity is also a flow statement.

Figure 6 below shows an example of how the flow statements link the opening and closing balance sheets.

In Section 5.1 you will look at the balance sheet and income statement for a sole trader. In Section 5.2 you will look at the same financial statements for a company. Section 5.3 discusses the statement of changes in equity for a company and Section 5.4 looks at cashflow statement for a company.